BYD Co., Ltd. (OTCPK:BYDDY) (OTCPK:BYDDF) is the world's largest manufacturer of EVs (electric vehicles). It is also a major player in e-buses, e-trucks, solar panels, energy storage and batteries. In addition, last year it launched its "Skyrail" transit system. Founder and chairman Wang Chuanfu surprised the markets when he previously announced a planned ten-fold increase in revenues by 2025.

That would take revenue up to 1 trillion yuan (US$151 billion). Recent news illustrates how he intends to do this. It provides a great long-term stock Buy opportunity after the stock price has fallen in recent months.

A big new contract win for Tesla (NASDAQ:TSLA) illustrates the growth coming up for battery manufacturers. This has been hugely underestimated by Tesla bears.

New China Battery Plant Needs

BYD began life as a battery manufacturer in 1995. Its early business was for cell phones and laptop computers. Today it is the world's largest supplier of batteries for mobile phones. It is now going all-in to supply batteries not just for its own vehicles but for others in the industry.

At the end of June, the company partially opened its new battery factory in Xining, an area of China with substantial lithium reserves. This adds to its current factories in Shenzhen and Huizhou.

The cost of the factory is expected to hit US$1 billion. The company plans another US$1.5 billion battery investment by 2020. The Xining facility will have an annual capacity of 24 GWh in the first phase. BYD expects its capacity to rise to 60GWh by 2020.

The much-heralded Tesla gigafactory in Nevada is targeting to build up its capacity in the medium term to 50 GWh. It is estimated it currently has capacity of approximately 20 GWh. It has an ultimate target of 105GWh. Earlier this year the company stated once again it planned a factory in China. Given its capital constraints, the timing is still uncertain.

However, Panasonic (OTCPK:PCRFY) announced this week that it was happy to consider further investment in the Nevada facility. A similar move in China is not unlikely. Tesla expects to triple its energy storage business this year but its problem has been getting supply to meet the demand. Panasonic's announcement is probably connected to a very substantial energy storage contract win just announced by the company.

PG & E (Pacific Gas & Electric Co) has contracted with Tesla (subject to State approval) for an energy storage project in northern California. This would enable power for 4 hours using 3,000 Tesla Powerpack 2 batteries. It is likely to be extended later up to 1.1 GWh which would enable 8 hours of power. This new project at the Moss Bay substation in Monterey County would be on a similar basis to the world's largest battery installed by Tesla. That was at the Hornsdale Power Reserve at Jamestown in South Australia.

That project has been very successful, both in the split second timing it takes to kick in, and in the 90% cost reduction over fossil fuel power station back-up. My previous article detailed some of these successes, and the future potential elsewhere in Australia. As in the USA, much of the impetus for business is coming from individual States rather than from central government.

It is believed Panasonic contributed about US$1.6 billion to the original US$5 billion investment in the Nevada plant. The bears have consistently underestimated Tesla's potential for getting more investment dollars.

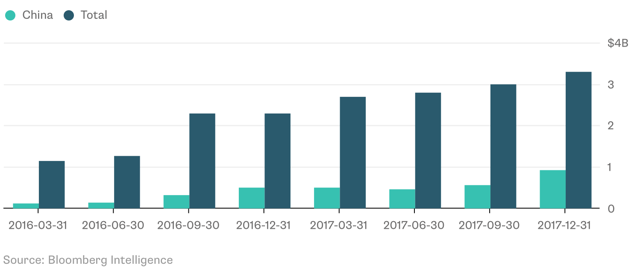

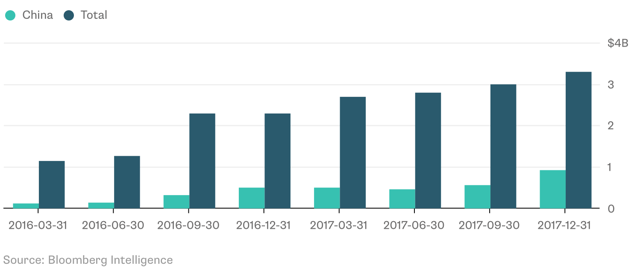

It is well known that Tesla has been negotiating for a gigafactory in Shanghai. Panasonic and Tencent (OTCPK:TCEHY) are both potential capital-raising partners. Those who say Tesla is failing in China are wrong. Its sales figures illustrate this:

2015 = US$318.5 million.

2016 = US$1.07 billion.

2017 = US$2.03 billion.

The illustration below emphasises the increasing importance of China for Tesla:

Bloomberg

However, to get the economies of scale needed, Tesla needs a large presence within China. The same is true of Europe. It needs to be less reliant on a U.S. market where new energy products may develop less rapidly than elsewhere for political reasons. It may be that individual States in the USA will continue to drive the business. However, because of the U.S. government's environmental policies, China is the long-term golden opportunity. As my article in November detailed, Asia is now the world's largest market for renewables. It is not just China. Huge opportunities arise in India, Japan and elsewhere in the world's most populous and fastest-growing continent.

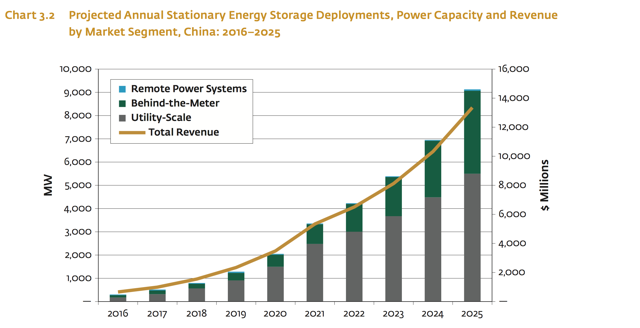

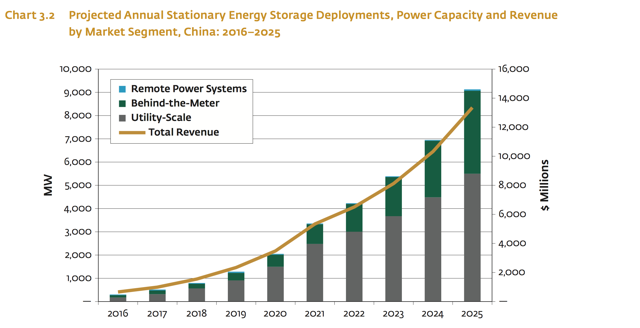

The detail below from the World Bank is telling:

World Bank

World Bank

This explains why BYD and others are investing rapidly in new battery gigafactories. It does not of course take into account the rapid rise in demand that will be necessitated by EVs as well.

CATL has been a fast-growing new battery manufacturer in China. It is the country's largest. It is currently building a new 24GWh factory. By 2020, it is expected to have 88GWH capacity. By comparison, BYD will have 60 GWh by then. Some observers reckon BYD missed a beat by allowing CATL to overtake it in size. However, it should be noted that BYD has been investing in many new areas. This includes the Skytrain business and overseas e-bus and e-truck factories.

BYD's current battery manufacturing capacity totals 16 GWh. That is enough to power 1.2 million hybrids. With the Xining facility, battery capacity by 2020 should amount to supply to 2.2 million EVs. That would be about US$24 billion in sales revenue in two years. With revenue forecast for US$21.5 billion this year, that could lead to a doubling in revenue by 2020. That would put the company partly on its way to targeting a ten-fold increase by 2025 as battery production ramps up.

BYD has the advantage of meeting its own usage in both cars and new energy products. It is now targeting supplying increasingly to outside companies. The Chinese Government has a target for EV sales to reach 2 million by 2020.

Currently, BYD manufactures prismatic LiFEPO4 (lithium ferrophosphate) cells. These differ from the standard auto industry NCA (nickel, cobalt and aluminium) and NMC (nickel, manganese and cobalt) cells. These have lower conductivity than some other types but are low in toxicity and have stable long-term performance. Next year it is expected it will start manufacturing its new more advanced NMC811 battery. Other new types are under development.

China is winning dominance of the industry from source. Chinese companies are winning control of the world's cobalt supplies, which mainly come from the Congo. Four-fifths of cobalt sulphates and oxides for cathodes used in lithium batteries are manufactured in China. It is estimated that the use of cobalt in EVs will rise from 9,000 tonnes in 2017 to 107,000 tonnes in 2026. Additionally, BYD has invested in a lithium processing venture in Qinghai.

Second Life Battery Capacity

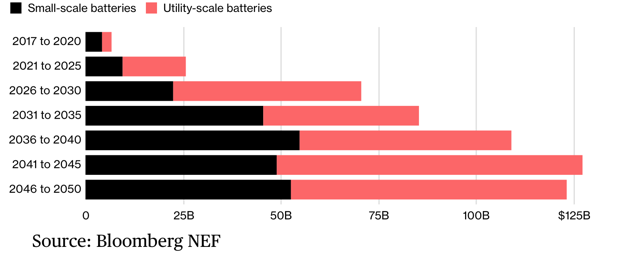

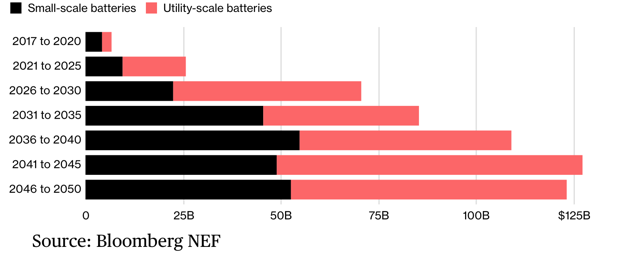

Lithium batteries will have a long potential life after their usage in EVs has expired. This has been calculated to be a potential US$550 billion industry in the future. 3.4 million lithium battery packs will be recycled annually by 2025. That number will rise exponentially as EV usage increases. The expected usage is illustrated below:

Bloomberg

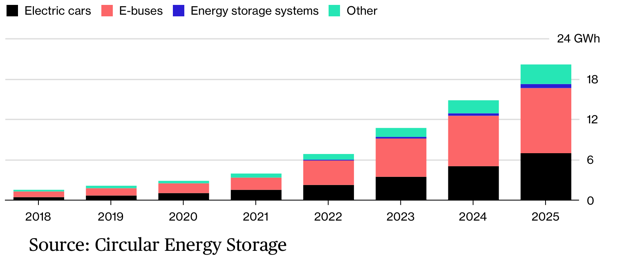

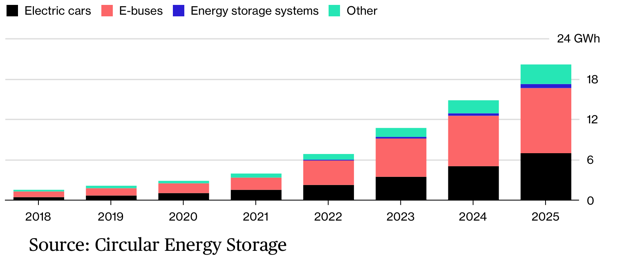

Autos have become the largest users of lithium batteries, overtaking consumer electronics. The breakdown of usage is illustrated below:

Bloomberg

As my recent article on e-buses detailed, BYD is a world leader in e-buses as well as being the world's largest EV auto manufacturer. So it will have huge capacity of second use lithium batteries in the near future. Far more cells are used in e-buses than autos. The company is opening a battery recycling plant in Shanghai. This is partly in response to Chinese Government directives concerning EV battery waste. It is also an economic opportunity.

Used batteries can be recovered and stripped down for their valuable metals. For BYD, a more likely option is large-scale usage for energy storage. Battery cells are the main cost in energy storage systems. So this should be a profitable business for BYD. When the batteries are no longer efficient for EV use, they still have 60% to 70% charge remaining. This would remain fairly constant for a long period of time. The relative value of the metals in the cells would be very low compared to what is likely to be continuing rising cost of minerals for new batteries.

The company has been expanding strongly into residential and commercial (up to grid scale) energy storage solutions, especially in Europe and Asia. It recently showcased a whole new modular range for the European market. Like Tesla, it has targeted Australia in the last year or so. My article in November last year detailed the huge opportunities for companies such as BYD and Tesla in this arena.

BYD also has a thriving solar panel business on an international scale. A recent indication of this was its US$30 million contract in Queensland for a 75 MW PV project. This shows the synergies in a country where BYD is very actively promoting its energy storage business.

Battery Plants in Europe

It has been reported that BYD is looking to set up a battery plant in Europe. It already has e-bus plants in Hungary and France, and a joint venture plant in the U.K.

A recent EU policy document calculated that the EU would need 22GWh by 2025. That would be equivalent to ten gigafactories. The EU has been discussing incentives for huge plants with the major battery players. So far there has been a lack of firm contracts. The EU has a target of getting 50% of its energy needs from renewables by 2030. So the demand for batteries in the next decade will be huge.

A report last week suggested Tesla is close to signing up for a 129 MWh battery to power a huge solar plant in S-E England. The plant is estimated to cost 拢400 million (US$524 million). If it comes to fruition, it would be three times the size of the world's largest battery installed last year by Tesla in South Australia. Planning permission is still some way off though.

This is another indication of how mistaken are those Tesla bears who even consider that Tesla should get out of the energy storage business altogether. An article on Seeking Alpha recently predicted that Tesla would exit the business. Given the huge potential seen by companies such as Tesla and BYD, this is a remarkable thesis. Especially so when you consider that energy storage is Tesla's fastest-growing sector, and the company has predicted it could exceed its auto business.

My article in May outlined the huge market opportunities for Tesla. The latest contract win in California is just another example of this. As Tesla increasingly sees itself as a battery business that sells autos, an exit from the business can be put down as a non-starter.

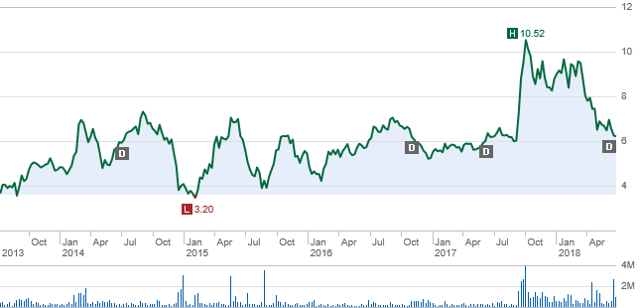

BYD Stock Price

BYD is expected to spin off its battery business into a separate unit to be floated on the stock market. This could add very meaningful value to stockholders. It is likely to happen in early 2019 but is not confirmed at this time.

The stock price has been hit recently by two main factors. Firstly, uncertainty over the direction of EV incentives in China. This concern proved to be misplaced. Secondly, it has been hit by the protectionist measures being brought in by the Trump administration.

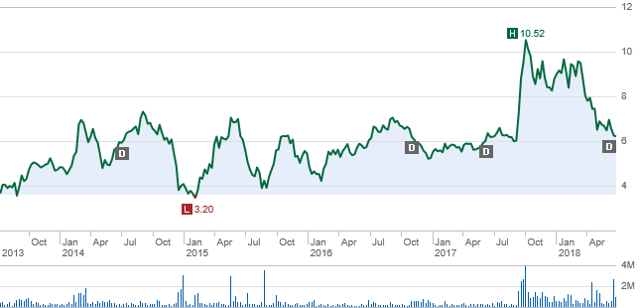

It has still been a good investment for those with a long-term perspective such as major investor Berkshire Hathaway (BRK.A) (NYSE:BRK.B). The 5-year chart below illustrates this:

Charles Schwab

My recent article highlighted why it can be seen as an excellent Buy after these pullbacks. The best timing of buying stock is uncertain, however. There are of course risks, as I detailed in an article in September last year. Since then the major risk has become the trade war instituted by the USA against China and the EU.

CEO and founder Wang Chuanfu is not given to hyperbole. His target to increase revenues from US$17 billion to US$151 billion by 2025 is a serious intent, whether or not it is successful.

For investors looking to play the long game, now represents an opportunity despite what may be short-term hiccups. Those who are more risk-averse may want to wait and see what happens in the trade wars narrative. BYD is not directly affected in that it does not export autos to the USA. Indeed it makes e-buses there. It is though likely to be hit by negative sentiment for autos in particular, and for Chinese stocks in general. In my article in January, I detailed some of the general risks inherent in Chinese stocks.

As for Tesla, the China potential emphasises the added importance of having investments on the ground in China. Tesla celebrated when China recently cut auto import tariffs. It cut the price of its autos in the Chinese market. Now the U.S. government's stance towards China has led to a new tariff in retaliation from the Chinese government. It is a classic example of how the USA's tariffs policy is hurting U.S. manufacturers and encouraging them to relocate production overseas. This was seen recently with Harley-Davidson (HOG) and with warnings from GM (GM).

Conclusion

For strategic, environmental and political reasons, China is seizing the world market for EVs and for batteries. On manufacturing grounds it has mapped out a very strong position for itself. The USA is far behind the curve. It will likely become more so given the stand on environmental matters by the Trump Administration.

On the auto front, there is of course plenty of room for both BYD and Tesla to thrive. This is true in China, in Europe and around the world. Tesla's marketing has been based on starting from the top and working downwards. BYD has achieved huge EV volumes based on fleet sales and is now working up in quality. Both have huge potential as the world moves towards an EV and energy storage future. Both will need substantial investments in battery manufacturing. This will keep them vertically integrated and able to control their own costs, and open up substantial sales to outside parties.

Tesla will probably further develop its business successfully. Its lack of finance compared to BYD will be a hindrance to reaching its full potential. However, the recent announcement by Panasonic shows there is not a lack of willing suitors. Chinese giant Tencent may well invest further in the company.

Both Tesla and BYD have what I look for in a company. That is, inspiring management with involvement in a secular growth sector.

On a world stage, Tesla is unlikely to achieve the volumes of BYD in either EVs or batteries. The growth market is so huge though that Tesla will still be a major player.

BYD has the financial advantage over Tesla. It has the economies of scale and the advantage of being located in China with a supportive, environmentally concerned government. BYD is well-placed to consolidate its position as the vertically integrated world market leader in the new energy sector.

Disclosure: I am/we are long BYDDF, TSLA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

TerraNova (CURRENCY:TER) traded up 16.4% against the US dollar during the 1-day period ending at 18:00 PM E.T. on July 22nd. One TerraNova coin can now be bought for about $1.64 or 0.00022122 BTC on popular exchanges including Livecoin, CoinExchange and Cryptopia. Over the last seven days, TerraNova has traded 0.3% higher against the US dollar. TerraNova has a market cap of $0.00 and $669.00 worth of TerraNova was traded on exchanges in the last 24 hours.

TerraNova (CURRENCY:TER) traded up 16.4% against the US dollar during the 1-day period ending at 18:00 PM E.T. on July 22nd. One TerraNova coin can now be bought for about $1.64 or 0.00022122 BTC on popular exchanges including Livecoin, CoinExchange and Cryptopia. Over the last seven days, TerraNova has traded 0.3% higher against the US dollar. TerraNova has a market cap of $0.00 and $669.00 worth of TerraNova was traded on exchanges in the last 24 hours.  Astro (CURRENCY:ASTRO) traded up 6.9% against the US dollar during the 1 day period ending at 23:00 PM Eastern on July 17th. Astro has a market cap of $4.09 million and $621.00 worth of Astro was traded on exchanges in the last 24 hours. During the last week, Astro has traded up 20.6% against the US dollar. One Astro token can currently be bought for $1.24 or 0.00016632 BTC on major cryptocurrency exchanges.

Astro (CURRENCY:ASTRO) traded up 6.9% against the US dollar during the 1 day period ending at 23:00 PM Eastern on July 17th. Astro has a market cap of $4.09 million and $621.00 worth of Astro was traded on exchanges in the last 24 hours. During the last week, Astro has traded up 20.6% against the US dollar. One Astro token can currently be bought for $1.24 or 0.00016632 BTC on major cryptocurrency exchanges.

Cramer: The real cause of the bank stocks' weakness isn't the yield curve—it's trade 49 Mins Ago | 11:08

Cramer: The real cause of the bank stocks' weakness isn't the yield curve—it's trade 49 Mins Ago | 11:08

World Bank

World Bank

Southern Missouri Bancorp, Inc. operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States. It offers various deposit instruments, including demand deposit accounts, negotiable order of withdrawal accounts, money market deposit accounts, saving accounts, certificates of deposit, and retirement savings plans. The company also provides loans for the acquisition or refinance of one-to four-family residences; loans secured by commercial real estate, including land, shopping centers, retail establishments, nursing homes and other healthcare related facilities, and other businesses; construction loans; and various secured consumer loans comprising home equity, direct and indirect automobile loans, second mortgages, mobile home loans, and loans secured by deposits. In addition, it offers commercial business loans, such as loans to finance accounts receivable, inventory, equipment, and operating lines of credit. As of June 30, 2017, the company operated 38 full-service branch offices, and 3 limited-service branch offices located in Poplar Bluff, Van Buren, Dexter, Kennett, Doniphan, Sikeston, Qulin, Matthews, Springfield, Thayer, West Plains, Alton, Clever, Forsyth, Fremont Hills, Kimberling City, Ozark, Nixa, Rogersville, Cape Girardeau, Jackson, Jonesboro, Paragould, Brookland, Batesville, Searcy, Bald Knob, Arkansas, and Illinois. Southern Missouri Bancorp, Inc. was founded in 1887 and is based in Poplar Bluff, Missouri.

Southern Missouri Bancorp, Inc. operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States. It offers various deposit instruments, including demand deposit accounts, negotiable order of withdrawal accounts, money market deposit accounts, saving accounts, certificates of deposit, and retirement savings plans. The company also provides loans for the acquisition or refinance of one-to four-family residences; loans secured by commercial real estate, including land, shopping centers, retail establishments, nursing homes and other healthcare related facilities, and other businesses; construction loans; and various secured consumer loans comprising home equity, direct and indirect automobile loans, second mortgages, mobile home loans, and loans secured by deposits. In addition, it offers commercial business loans, such as loans to finance accounts receivable, inventory, equipment, and operating lines of credit. As of June 30, 2017, the company operated 38 full-service branch offices, and 3 limited-service branch offices located in Poplar Bluff, Van Buren, Dexter, Kennett, Doniphan, Sikeston, Qulin, Matthews, Springfield, Thayer, West Plains, Alton, Clever, Forsyth, Fremont Hills, Kimberling City, Ozark, Nixa, Rogersville, Cape Girardeau, Jackson, Jonesboro, Paragould, Brookland, Batesville, Searcy, Bald Knob, Arkansas, and Illinois. Southern Missouri Bancorp, Inc. was founded in 1887 and is based in Poplar Bluff, Missouri. Heritage Financial Corporation operates as the bank holding company for Heritage Bank that provides various financial services to businesses and individuals in the United States. The company accepts various deposit products, such as noninterest demand accounts, interest bearing demand deposits, money market accounts, savings accounts, personal checking accounts, and certificates of deposit. Its loan portfolio includes commercial and industrial loans, owner-occupied and non-owner occupied commercial real estate loans, one-to-four family residential loans, real estate construction and land development loans, consumer loans, business lines of credit, term equipment financing, and term real estate loans, as well as commercial loans focuses on real estate related industries and businesses in agricultural, healthcare, legal, and other professions. The company also originates loans that are guaranteed by the U.S. Small Business Administration; and offers trust services through trust powers, as well as objective advice. As of December 31, 2017, the company had a network of 59 branches located in Washington and Oregon. The company was formerly known as Heritage Financial Corporation, M.H.C. and changed its name to Heritage Financial Corporation in 1998. Heritage Financial Corporation was founded in 1994 and is headquartered in Olympia, Washington.

Heritage Financial Corporation operates as the bank holding company for Heritage Bank that provides various financial services to businesses and individuals in the United States. The company accepts various deposit products, such as noninterest demand accounts, interest bearing demand deposits, money market accounts, savings accounts, personal checking accounts, and certificates of deposit. Its loan portfolio includes commercial and industrial loans, owner-occupied and non-owner occupied commercial real estate loans, one-to-four family residential loans, real estate construction and land development loans, consumer loans, business lines of credit, term equipment financing, and term real estate loans, as well as commercial loans focuses on real estate related industries and businesses in agricultural, healthcare, legal, and other professions. The company also originates loans that are guaranteed by the U.S. Small Business Administration; and offers trust services through trust powers, as well as objective advice. As of December 31, 2017, the company had a network of 59 branches located in Washington and Oregon. The company was formerly known as Heritage Financial Corporation, M.H.C. and changed its name to Heritage Financial Corporation in 1998. Heritage Financial Corporation was founded in 1994 and is headquartered in Olympia, Washington. Wall Street brokerages expect Kite Realty Group Trust (NYSE:KRG) to announce $0.50 earnings per share (EPS) for the current quarter, Zacks Investment Research reports. Five analysts have made estimates for Kite Realty Group Trust’s earnings, with the lowest EPS estimate coming in at $0.49 and the highest estimate coming in at $0.51. Kite Realty Group Trust reported earnings per share of $0.54 during the same quarter last year, which suggests a negative year over year growth rate of 7.4%. The company is scheduled to report its next quarterly earnings results on Wednesday, July 25th.

Wall Street brokerages expect Kite Realty Group Trust (NYSE:KRG) to announce $0.50 earnings per share (EPS) for the current quarter, Zacks Investment Research reports. Five analysts have made estimates for Kite Realty Group Trust’s earnings, with the lowest EPS estimate coming in at $0.49 and the highest estimate coming in at $0.51. Kite Realty Group Trust reported earnings per share of $0.54 during the same quarter last year, which suggests a negative year over year growth rate of 7.4%. The company is scheduled to report its next quarterly earnings results on Wednesday, July 25th.

Facebook released an example of what the ad labels will look like on Thursday

Facebook released an example of what the ad labels will look like on Thursday  Shares of Amgen (NASDAQ:AMGN) have earned an average recommendation of “Hold” from the twenty-seven research firms that are presently covering the company, Marketbeat reports. Two investment analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and ten have given a buy rating to the company. The average 1 year target price among brokers that have issued a report on the stock in the last year is $193.19.

Shares of Amgen (NASDAQ:AMGN) have earned an average recommendation of “Hold” from the twenty-seven research firms that are presently covering the company, Marketbeat reports. Two investment analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and ten have given a buy rating to the company. The average 1 year target price among brokers that have issued a report on the stock in the last year is $193.19.  Thinking of selling your home? Do it before 2020, economists say

Thinking of selling your home? Do it before 2020, economists say  Why the end is coming soon for the biggest tech bubble we��ve ever seen

Why the end is coming soon for the biggest tech bubble we��ve ever seen  Here��s what happens if the oil rally turns into an ��oil shock��

Here��s what happens if the oil rally turns into an ��oil shock��  Trump hints at more tax cuts to be unveiled before November

Trump hints at more tax cuts to be unveiled before November  Here's all you need to do in your 30s for a great financial future

Here's all you need to do in your 30s for a great financial future  Barbara Kollmeyer

Barbara Kollmeyer

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Advanced Search Stocks Columns Authors Topics No results found E-Mini Dow Jun 2018 U.S.: CBOT: YMM8 $24,711.00 -134.00 (-0.54%)

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Advanced Search Stocks Columns Authors Topics No results found E-Mini Dow Jun 2018 U.S.: CBOT: YMM8 $24,711.00 -134.00 (-0.54%)