Image source: The Motley Fool.

Biodelivery Sciences International Inc (NASDAQ:BDSI)Q4 2018 Earnings Conference CallMarch 14, 2019, 4:30 p.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:

Operator

Greetings and welcome to BioDelivery Sciences Fourth Quarter and Fiscal Year 2018 Earnings Call. (Operator Instructions) As a reminder, this conference is being recorded. I would now like to turn the conference over to your host, Terry Coelho. Please go ahead.

Terry Coelho -- Chief Financial Officer

Thank you and good afternoon, everyone. Welcome to our fourth quarter and year end 2018 earnings conference call. Leading the call today is Herm Cukier, Chief Executive Officer; We're joined by Scott Plesha, President and Chief Commercial Officer and Dr. Thomas Smith, Chief Medical Officer. Following our prepared remarks, we will conduct a question-and-answer session.

Earlier today, BioDelivery Sciences issued a press release announcing its financial results for the fourth quarter and year end 2018. A copy of the release can be found on the Investor Relations page of the Company's website. Before we begin, I would like to remind everyone that certain statements may be made during this call, which may contain forward looking statements, such forward looking statements are based upon current expectations, and there can be no assurances that the results contemplated in these statements will be realized.

Actual results may differ materially from such statements due to a number of factors and risks, some of which are identified in our press release and our annual, quarterly and other reports filed with the SEC. These forward looking statements are based on information available to BDSI today, March 14, 2019, and the Company assumes no obligation to update statements as circumstances change. An audio recording and webcast replay for today's conference call will also be available online in the Investor Section of the Company's website.

With that, I'll turn the call over to Herm Cukier. Herm?

Herm Cukier -- Chief Executive Officer

Thank you very much, Terry and thank you all for joining us this afternoon. It is my pleasure to welcome you to the BDSI fourth quarter and full year 2018 earnings call. To begin with, I would like to welcome Terry, our new Chief Financial Officer. Terry brings broad expertise in business and leadership across all areas of finance, and will play an integral role as we focus on our commercialization strategy through our next phase of growth. Welcome, Terry. We're delighted to have you as part of our executive leadership team.

As Terry indicated, we are also joined on the call today by Scott Plesha, our President and Chief Commercial Officer and Dr. Thomas Smith, our Chief Medical Officer. Each of these executives will share more details on our continued accomplishments and positive expectations for 2019 and beyond. By every measure, the fourth quarter and full year 2018 was a vast success for BDSI. I am very pleased by our results to-date and have the utmost confidence in our ability to sustain this positive momentum moving forward.

We have made significant strides in transforming the Company into a rapidly growing commercial stage enterprise. I would like to thank all of our employees for their hard work and dedication throughout the year. It is their commitment and constant positive energy that has enabled this transformation to occur. Because of their efforts, thousands of patients living with chronic pain are benefiting from the therapeutic effect of a truly novel and important product like BELBUCA, and we are just getting started. We have achieved our stated intent to strengthen the Company, control our own destiny and be well positioned for sustained growth. When we started this transformation in May of last year, I laid out a straightforward plan that would enable the success to occur.

First, it was imperative to significantly accelerate the growth of BELBUCA, recognizing it as in the early stages of its launch and has a distinctive clinical proposition for patients. While I will let Scott share more of the details of the success, I am very pleased to these scripts reach an all time high during the fourth quarter. In addition, there were record number of new and unique BELBUCA prescribers throughout the quarter, also reaching all time high in December.

Second, ensuring patients had access to both BELBUCA was of the utmost importance and became one of our top priorities throughout the year. I am very proud that we have secured a preferred position across the majority of the largest national insurance companies. In fact, we even added more than 25 million lives in the fourth quarter alone and so as we enter into 2018, more than 100 million covered lives across the country had preferred access to BELBUCA, an outstanding accomplishment, considering we entered the year with only 8 million having so. This number continues to expand as we enter 2019, a testament to the growing recognition of BELBUCA as an important treatment option in this patient population.

Third, we strongly believed it was necessary to more broadly and effectively communicate the scientific evidence supported BELBUCA as an important treatment option for chronic pain. This meant ensuring we have the right sales seem to appropriately reach HCPs using opioids in treating chronic pain, and building a medical team to leverage scientific platform such as publications, congresses, et cetera.

We made a strategic decision to hire, train and deploy the new teams during the second half of 2018, they will hit the ground running as the new year began. Tom and Scott will share more of the details, but we are already seeing the impact of our new colleagues across the country and certain this investment will help ensure success in 2019 and beyond.

And finally, having a senior leadership team with the experiences and skills to both accomplish the near-term tasks and be capable of driving our ambitions for the longer term wasn't the utmost importance and a personal priority of mine. I am extremely proud to have industry leaders such as Tom and Terry, in addition to Jim Vollins, our General Counsel and Chief Compliance Officer, joining existing top talent such as Scott and Jody Lockhart, our Head of Operations.

We are unified in our ambition and confident in our ability to make BDSI, a highly successful specialty pharmaceutical company. In summary, the fourth quarter and full year 2018 were extremely successful for BDSI. We accomplished each of the key strategic imperatives laid out last year and are positioned ourselves for continued growth and success.

I will now turn the call over to Scott, who'll share more details of our operational performance. Scott?

Scott Plesha -- President and Chief Commercial Officer

Thank you, Herm. As Herm noted, we experienced a very strong fourth quarter and 2018 with BELBUCA. Not just increasing, but accelerating prescription and revenue growth. BELBUCA strong growth results in our reaching an all time high during the quarter had over 56,000 prescriptions. We've now reached all time consecutive quarterly highs ever since we relaunched BELBUCA and the growth we experienced in Q4 was the largest quarter-over-quarter growth we've seen at almost 12,000 prescriptions.

We'd still accelerate our prescription growth in Q4 and believe there are key drivers supporting this growth. Since early 2018, we've seen a consistent increase in our new prescribers as well as the number of prescribers each quarter. During the fourth quarter we saw that trend continue and even accelerate. During the fourth quarter, there were more than 5350 unique BELBUCA prescribers and nearly 1100 new prescribers, both of these metrics represent meaningful increases over Q3 2018 and our all time highs since the relaunch of BELBUCA. During the quarter, we increased our prescriber base and saw prescription and share growth across every decile of HCPs, which demonstrates the growing acceptance of BELBUCA.

In addition, all of our BELBUCA dosage strengths exhibited accelerated growth during the fourth quarter, with every strength growing greater than 22%. This not only demonstrates the comfort HCPs have in prescribing BELBUCA across all doses strengths, but also having seven doses strengths importantly allows a patient's care to be tailored to the lowest efficacious dose.

During 2018, we greatly increased the number of patients that we receive BELBUCA for the first time. As we enter 2018, there were approximately 1700 chronic pain patients per month being prescribed BELBUCA for the first time. By Q4 of 2018, the number of new BELBUCA patients have increased to over 4000 per month. This increase in patients receiving BELBUCA for the first time demonstrates that healthcare providers identifying patients that are appropriate to receive BELBUCA at an increased rate, and this is critical to the accelerated growth of the brand.

As Herm mentioned, we improved our market access greatly in 2018, increasing the number of lives from under 8 million with preferred access to over 100 million. In November, BELBUCA was added to OptumRx as preferred formulary list, adding over 25 million covered lives with access to BELBUCA. Most recently, we announced that BELBUCA had been moved from not-covered to preferred formulary in Cigna Healthcare. This win became effective February 1, 2019, and provides improved access for BELBUCA for over 7.3 million lives.

With our recent wins, there are over 50% of combined commercial and Medicare lives covered in prepared Tier 2 position, which is up significantly from 3% of lives covered at the beginning of 2018. With these recent wins, BELBUCA is now covered or better in 92% of commercial lives. Importantly, the BDSI commercial team has done an excellent job of executing against these wins and has driven consistent prescription growth in each PBM or plan since the contracts were executed.

We continue to see strong interest and acceptance by the commercial and government payers of BELBUCA's differentiating qualities and we are very optimistic about adding more wins. While it's difficult to predict when these wins will occur, we are confident that over time, the number of lives having preferred access to BELBUCA will continue to rise. We are excited by the progress we made in 2018 and are confident we can continue to build upon our current growth. We believe that our sales force and market access team expansions that were both completed at the end of Q4 will be key to our success in 2019 and beyond. These increases in personnel will allow us to continue to build improve market access to BELBUCA and allow for the proper reach and frequency with our 10500 targets to maximize results. We are encouraged that early into our expansion, we've already seen an acceleration in new and total prescribers. I'm excited by the success we had in 2018 and the fact that BELBUCA's growth has continued into 2019 resulting an all time period (ph) high for January and February.

As we go forward into 2019, we'll continue to focus on improving market access, growing the number of patients receiving BELBUCA for the first time and expanding our prescriber base. I'm also very excited about how our medical plan will complement the efforts of the commercial team and with that I turn thing -- I'd like to turn things over to Dr. Tom Smith, our Chief Medical Officer, to provide the highlights of the medical plan and the initiatives that are being executed.

Thomas B. Smith -- Chief Medical Officer

Thank you, Scott. It's a pleasure to update everyone here on the progress we have made since we have last spoken in November. I have been in my role now for eight months and I'm very pleased by the scientific discourse, the increased understanding and the impact that I'm consistently hearing in meeting with our prescribers, key opinion leaders and other customers. Late last year, I shared with you our 2019 Medical Plan and the importance of cementing and the understanding around BELBUCA's efficacy, safety and tolerability.

This past Saturday at the American Academy of Pain Medicines Congress in Denver, BDSI sponsored a scientific symposium and three of the world's top KOLs presented on BELBUCA's mechanism of action, pharmacology, clinical data and use in chronic pain. The medical team has identified several additional key scientific congresses, which we'll focus on this year, and for each of these meetings, we have plans in place to ensure a steady stream of medical communication and education around BELBUCA.

One of the events that I spoke about last year was the expert opinion consensus program. It is moving forward and will provide recommendations for convergence as well as address the appropriate use of opioids in patients suffering from chronic pain. Given the importance of this topic, I would expect that the manuscript will be submitted to a top tier medical journal. There is a real need to elevate the scientific understanding and awareness around drug safety, given the rising number of Americans dying each day to -- due to opioid overdose. Chief among these adverse events is the very real possibility of life threatening respiratory depression in patients taking any CNS depressant, and our team plans to explore a new clinical study looking specifically at this critical topic. To further solidify BELBUCA's efficacy, safety and tolerability, the team is moving forward with a very robust publication plan. Already they are overseeing the development of manuscripts and scientific congress abstracts. Our plan is to have a steady cadence of medical literature to help inform our healthcare providers.

Finally, to further strengthen the team, serve as a resource to our prescribers and others throughout the scientific community and to ensure appropriate use of BELBUCA, we will expand our NFL team next month.

So in summary, we are fully executing on the medical plan exactly as was outlined last year. As I mentioned then, what gives me as a physician the most satisfaction is knowing that this plan through its initiatives and education, will create awareness and understanding around BELBUCA, allowing millions of patients who are suffering from chronic pain can now have access and to benefit from this medication.

With that, I will turn the call over to Terry Coelho to cover the financials in more detail. Terry?

Terry Coelho -- Chief Financial Officer

Thank you, Tom. Fourth quarter financial results exceeded those third quarter and prior year quarterly results, as well as exceeding the high end of the expectations that we provided last quarter. Total net revenue for the fourth quarter ended December 31, 2018, was $18 million, an increase of 27.4% compared to $14.2 million in the third quarter of 2018 and an increase of 44.1% compared to $12.5 million in the fourth quarter of 2017.

Total net revenue for the full year 2018 was $55.6 million, a decrease of 10.2% compared to $62 million for the year ended December 31, 2017. Total net revenue for 2017 included $20 million in contract revenues recorded in January 2017 as part of the termination of the licensing agreement with Endo and the return of BELBUCA rights to BDSI. 2018 total net revenue growth was 32.5%, excluding the aforementioned $20 million in contract revenues.

The total net revenue growth was driven primarily by BELBUCA, which comprised 88% of our total net revenue in the quarter. BELBUCA net revenue in the fourth quarter ended December 31, 2018, was $15.9 million, an increase of 28.3% compared to $12.4 million in the third quarter of 2018 and an increase of 68.3% compared to $9.4 million in the fourth quarter of 2017. Gross to net deductions in the fourth quarter were 47.9% percent for BELBUCA and we are essentially in line with the third quarter deductions at 47.8%. Gross profit for BELBUCA was 86.6% in the fourth quarter and reflects the higher yields and lower costs resulting from our transition to new packaging equipment that we discussed last quarter.

Total gross margin from both commercial products increased to 81% in the fourth quarter, compared to 76% in the third quarter. Total operating expenses in the quarter reflect our continued investment in our commercialization efforts. For the fourth quarter ended December 31, 2018, total operating expenses were $18.5 million compared to $14.2 million in the third quarter of 2018, and $21.6 million in the fourth quarter of 2017. The quarter-over-quarter increase in operating expenses was driven primarily by the sales force expansion and medical team growth. Total operating expenses for the full year 2018 were $63.5 million as compared to $71.9 million for the full year 2017. The year-over-year reduction was primarily due to 2017 costs associated with joining the opioid consortium along with remaining R&D expenses.

On a GAAP reported basis, the net loss for the fourth quarter was $7 million or $0.10 per share compared to a loss of $18.9 million or $0.29 per share in the third quarter of 2018. The GAAP net loss for the full year 2018 was $46.4 million or $0.73 per share, compared to net income of $5.3 million or $0.09 per share for the full year 2017 on a comparable basis. The full year 2018 GAAP net loss included a onetime non-cash charge of $12.5 million or $0.19 per share for the beneficial conversion feature of the Series B Preferred Stock.

Non-GAAP net loss for the full year 2018 was $33.9 million or $0.54 per share, excluding the impact of the beneficial conversion feature just mentioned. Compared to the full year 2017, non-GAAP net loss of $22.1 million or $0.40 per share, which excludes the bargain purchase gain of $27.3 million from the reacquisition of BELBUCA. At December 31, 2018, BDSI had cash and cash equivalents of approximately $43.8 million. This compares to cash and cash equivalents of approximately $21.2 million at December 31, 2017, and $49.5 million at September 30, 2018.

As a reminder, in Q2 of 2018, the Company successfully completed a $50 million equity financing raise, which, together with the solid performance over the past few quarters, has strengthened the balance sheet. In the coming months, I will be focusing on identifying opportunities to further improve our cash position and profitability, as well as our business processes and our finance capabilities to ensure we are well-positioned to invest in and fully capitalize on the growth potential of BELBUCA.

Finally, looking ahead to 2019, and based on the strong momentum with which we entered the year, we see 2019 BELBUCA net revenue to be in the range of $80 million to $85 million and total Company net revenue to be in the range of $85 million to $90 million. This outlook incorporates an estimated net impact of approximately 5% from the BELBUCA price increase effective earlier this week.

As a result of the higher net revenues, along with our ability to leverage our SG&A expenses as we grow, we currently expect that we will be operating cash flow positive in 2019. In the longer term, we believe our sustained momentum will allow us to achieve annual sales in the range of $250 million to $300 million as BELBUCA continues to evolve into the therapy of choice for the management of chronic pain.

At this point, I'd like to turn the call back over to her Herm for some concluding remarks before we open the call for Q&A. Herm?

Herm Cukier -- Chief Executive Officer

Thank you, Terry. As a team has highlighted 2018 was a very successful year for BDSI, further exemplified by continued strong performance in the fourth quarter and early momentum in the new year. We had accelerated the growth of BELBUCA, put the right people and teams in place and have the funds to properly capitalize on our opportunities. We have increased BELBUCA expectations for 2019, expect to be operationally cash flow positive in the year and have expanded our long term ambition for the product. In conclusion, we have become a rapidly growing commercial company with a very bright future.

I will now turn the call back to the operator for Q&A. Operator?

Questions and Answers:

Operator

At this time, we'll be conducting a question-and-answer session. (Operator Instructions) Our first question comes from the line of Brandon Folkes with Cantor Fitzgerald. Please proceed with your question.

Brandon Folkes -- Cantor Fitzgerald -- Analyst

Hi, thanks for taking my questions and congratulations on the strong results and guidance. Herm, firstly, can you talk about some of your access win assumptions that go into your wide peak sales estimates and maybe given the success that you've seen with BELBUCA since, the last time we heard from you guys. Do you still think your sales force is right-sized or has the success made you think otherwise on that? And then lastly, how should we think about capital allocation going forward? The stock's done quite well. Would you consider an equity raise to expand either the sales force or bring in additional products? Thank you.

Scott Plesha -- President and Chief Commercial Officer

Thanks, Brandon. It's Scott. Appreciate the question. So, first off, talking the market access and its impact on our peak sales. Right now, we've mentioned we're a little over 50% preferred lives. We're really excited about the progress we've made in 2018. It was actually an excellent year for us in opioid access to patients. However, we still have work to do, probably on the Medicare side and more than anything and on regional plans.

We recently completed expansion of the market access team. So, we are seeing really nice pull through in our market access wins. So our shares go higher within them. So a lot of upside there. So, we're excited about continuing to pull that through. The trends have been very consistent within those wins and there's really no reason to believe that, that would change going forward.

We'll continue to try to layer on additional wins as we go forward. As far as sales force size, we're really confident that we've done some good work up front on the sizing, zeroed in on about 10500 targets. So each were up, has somewhere between 80 to 100 and 110 targets. We feel that's right sized, where we are right now. Keeping in mind that the opioid space is really consolidated and the pain management doctors primarily are the large writers there so. So, while just have a very focused in specialty pharma sales organization, and I'll let Herm handle the last question.

Herm Cukier -- Chief Executive Officer

Yeah. Thanks so much, Scott. And good afternoon, Brandon. Thank you for your question, it is really appreciated. And -- I would say that right now we have to remind ourselves that BELBUCA is still very much in the early stages of its launch. So a lot of hard work and heavy lifting. Obviously, we're very pleased by the successes we accomplished in 2018 with the product, the transformation of the Company as we just described, the early

momentum that we have through the first few months of this year. But we still have a lot of hard work to truly fully capitalize on the opportunity that we have at hand with the product.

But, we've put ourselves in a position of strength and we've put ourselves in a position of controlling our destiny. We now have a leading commercial infrastructure, Scott and his sales team did a tremendous job with customers day in, day out. And over time, we'll clearly have more opportunity to do more with that commercial infrastructure and we'll be opportunistic and we'll strike from a position of strength if we see something that makes sense. But that's down the road. Right now, we're keenly focused on ensuring that we fully execute flawlessly day in and day out with BELBUCA and continue to drive the further acceleration uptake of that product.

Brandon Folkes -- Cantor Fitzgerald -- Analyst

Thank you very much and maybe if I can sneak in one more from me. Did you take a price increase this week on BELBUCA? Am I Correct in that assumption?

Herm Cukier -- Chief Executive Officer

Yes, that is correct. As Terry pointed out, that did go into effect early this week. And we expect the net result to be approximately in the 5% range.

Brandon Folkes -- Cantor Fitzgerald -- Analyst

Okay, and did you see any buying at the end of the quarter? I'm just trying to think about how we should model 1Q going into Q2, is the inventory and the channel potentially at the end of 1Q, just when we muddling (ph)?

Herm Cukier -- Chief Executive Officer

All right, I understand your question. I appreciate that, Brandon. And I guess I would say that at this point, there's no difference in buying patterns from what we've been experiencing since the relaunch of the product.

Brandon Folkes -- Cantor Fitzgerald -- Analyst

Great. Thank you very much.

Herm Cukier -- Chief Executive Officer

Thank you, Brandon.

Operator

Our next question comes from the line of Esther Hong with Janney. Please proceed with your question.

Esther Hong -- Janney -- Analyst

Hi. Congratulations on the successful quarter and year, and thanks for taking my question. So just a few. So first, can you talk about the market share for BELBUCA and any trends that you're seeing and then second, regarding the new prescribers. Are these physicians who are already familiar with BELBUCA, but didn't prescribe it because of coverage? Or are these prescribers who were not previously familiar with BELBUCA, but gained access through the sales force and other -- other types of awareness? And then third, can you tell us what you've been seeing with prescribing patterns in terms of different dosage strength? I know that there was -- you had mentioned there was growth across all strengths. What are the most highly prescribed doses? Thanks.

Scott Plesha -- President and Chief Commercial Officer

Hi. It's Scott, I'm sorry. I'll take these one at a time. So, a lot of our growth -- our market share has been growing quite rapidly. So to kind of frame that in the long acting opioid space, we entered the year about seven-tenths of a share point. So under 1%. As we exited, we're up to 1.8% in the month of December. And we -- Herm and I both mentioned the acceleration we've even seen into 2019. And as we sit here in February, it's up to 2.2% market share there. And then even looking at -- European market, which really is a subset, we're up to almost 34% in the month of February.

So -- but, keep in mind, when we look at our data, we're not just taking patients from a long acting opportunity, the majority of our patients are either coming, being switched from, or added to short acting. So, it's a much broader marketplace there. As far as new prescribers go, I think this is playing out right into our expansion plans. When we looked at our reach and frequency and our market share and penetration, it was probably light in the middle of deciles and in fact, when we look at our -- it's early yet. So, the expansion really just got completed at the end of the quarter -- end of Q4, but we are seeing a nice uptick within those middle deciles due to our activity in those deciles, growing across all of them. But probably, the more -- the largest growth within that area. So again, that was part of our strategy.

As far as dosage strength go, we break them down to a couple of different ways. So, the 75, 150 and 300, we will call those starting our initiation doses per label. But those are the areas where patients most frequently start on BELBUCA. And in fact, the 150 and the 300 are the most proscribed and they -- patients don't always go beyond that. But in our studies, a lot of times they were titrated up as needed to get the efficacy. And there's really not a big shift between those doses and higher doses, so the 450 to 900, it move the percentage or two. However, we did. We have seen every quarter really since we relaunched those titration doses have increased in pure growth.

And I think what that points to is, patient staying on long term, having good results and being happy with the product. So that's crucial. And then the other part is the funnel or new patients coming in at that 150 to 300 has accelerated as well. So those two things are both important and we're really encouraged by what we're seeing there. And I'm sorry, what's the -- (multiple speakers). Was there fourth?

Esther Hong -- Janney -- Analyst

I could -- can I ask the fourth?

Scott Plesha -- President and Chief Commercial Officer

Sure.

Esther Hong -- Janney -- Analyst

Okay. Just a follow up. So --

Herm Cukier -- Chief Executive Officer

Scott is ready for one more.

Esther Hong -- Janney -- Analyst

Okay. So, there was a recent Endo filing by a few generic competitors and can you speak about any sort of previous settlements and anything that it is -- that gives you confidence that the patents will be protected moving forward? Thanks.

Herm Cukier -- Chief Executive Officer

Hi. Esther. thank you so much for your questions, greatly appreciated. And has this public. There have been two additional Paragraphs 4 filings on top of the first to file, which was Teva and to your question, we have obviously reached an agreement with the first to file Teva, which was done after their diligence and discovery process, which I think speaks to the fortitude and resilience of our intellectual protection, which we are extremely confident of, and which we will continue to defend as needed with rigor and the utmost confidence. So, there are two other Paragraph 4 filers and they're on the same patents. And so, for us, this is a continuation of and maybe as a sign of success, that is the product grows, there will be others that, that will follow afterwards, but perhaps this is just a continuation of the rigorous defense of our intellectual property protection. And there's nothing different from the process that was ensued by first to file which was Teva.

Esther Hong -- Janney -- Analyst

Excellent. Thank you. Congratulations.

Herm Cukier -- Chief Executive Officer

Thank you so much. Thank you.

Operator

Our next question comes from the line of Tim Lugo with William Blair. Please proceed with your question.

Tim Lugo -- Tim Lugo -- Analyst

Thanks for the question and congratulations on all the BELBUCA growth in 2018 and 2019 so far. I guess a little bit broader picture, we have a major player in the opioid field discussing bankruptcy protection. Can you give us an idea of what you're seeing from the field potentially due to their marketing pullback and what stage are you in terms of benefiting from this? I just don't quite see how this could do anything, but be a positive for BELBUCA.

Herm Cukier -- Chief Executive Officer

Hey, Tim. How are you, this is Herm. Thank you so much for the accolades and for your question. You know, I think I'll turn it over to Tom in a minute to talk a little bit more about some of the things that he and the medical team are working on, from a medical perspective, and it's just how different BELBUCA really is from the CII opioids. But I think -- that our focus is, as we've been saying all along, is ensuring that we help the medical community fully understand the clinical value proposition that, that product like BELBUCA offers to this patient population, not only in the safety profile, which I think we've exemplified continuously, and I think there's an appreciation for, but it is indeed an extremely effective analgesic agent and we believe that it warrants merit as a core therapy for the broader treatment of chronic pain.

But I'll turn over to Tom and he will talk a little bit more about, from a physician perspective, just how differentiated the (inaudible) and the aspects of the historical concerns that have existed with CII, it's just not something that applies in the same way to BELBUCA.

Thomas B. Smith -- Chief Medical Officer

Right. Thank you, Herm. Thank you for the question. But yeah, the environment has changed a lot just in the past several months, certainly within the past year. I was sharing this weekend, you know, we had the Scientific Symposium at 8:00 p.m. and, you know, we had standing room only, right and the very few people left even before the Q&A wrapped up. So, there's a lot of interest and I remember just a year ago, buprenorphine not even be in discussion at many of these congresses around pain. So physicians are wanting to know, right. There's a lot of external pressures that are on right now, there's the pressures from Medicare to get folks under 90 MMEs of of a CII opioid. I highlighted during my talks this evening that we're going to do the study looking at the very real possibility of respiratory depression. Everyday, we hear stories about people who are taking their chronic pain medication, their opioid. Then they go home and they have a glass of wine at dinner. And then perhaps at night when they go to bed, they take their benzodiazepine to help them sleep. And unfortunately those -- some of those people do end up passing away.

So, we believe, as Herm mentioned, BELBUCA is a different molecule. We know it's safety profile and when you think about the adverse events of these opioids, chief among them is the possibility of respiratory depression. We know we have a ceiling effect when it comes to that. So, we think this is a great opportunity to expend on that. So really looking forward to the plans that we have in place for this year. But, great question.

Tim Lugo -- Tim Lugo -- Analyst

Understood. And maybe following up on the clinical study, can you talk about maybe how many patients you're expecting to enroll? What's the time frame of the study? And also maybe for Terry, we have seen R&D a pretty low levels over the past few quarters. I expect that to probably will pick up as you start off a new study?

Thomas B. Smith -- Chief Medical Officer

Right. So this was the study I was talking about late last year when I laid out my medical plan there at the Analyst Day in October and then spoke further about it in November. So this has all been accounted for. What I see is that, we will work on that protocol here, yes, this month, hopefully get it IRB approved in the next month or so. It will take several months, so to conduct the study, but be comparing ourselves, be comparing BELBUCA directly against a schedule 2 opioid right? So I really think that news will be informative and will really help with physicians in their decision making.

Terry Coelho -- Chief Financial Officer

Hi Tim, this is Terry. So, just to address your question on the R&D spend, what I would say at this point is that any spend that Tom is contemplating is already factored into our cost structure. And we're continuously evaluating our strategic choices, making prioritizing our spend. And I think you can expect to see a pretty steady trend.

Tim Lugo -- Tim Lugo -- Analyst

Understood. Thanks for the questions.

Herm Cukier -- Chief Executive Officer

Thank you, Tim.

Operator

(Operator Instructions) Our next question comes from the line of Matt Kaplan with Ladenburg Thalmann. Please proceed with your question.

Matt Kaplan -- Ladenburg Thalmann -- Analyst

Hi, guys. Thanks for taking the questions and congrats on the quarter. I just want to circle back a little bit to your access wins. And I guess the question is, are there additional pairs you're in negotiations with to gain preferred access? And when could we see some of these negotiations start to have an impact and have a resolution?

Scott Plesha -- President and Chief Commercial Officer

Thanks for the question, Matt. It's Scott. So we're always obviously out doing clinical presentations and talking with market access companies, plans and TVMs (ph), there's really no way to predict the timing of them. You saw that last year, we sprinkled them throughout the year. Although, say -- we're having really meaningful -- really meaningful conversation. We made really, really important progress last year. If you've kind of benchmark where we are, it's getting close to where some of the top brands have been over time. So, there'll be more -- more regional plans. Medicare, we need to do some work, but we're confident we'll add more. We'll be 25 million lives at a time. There's really not many of those locked out there. So you -- I can promise those we're committed to providing the proper access to this product to patients.

Matt Kaplan -- Ladenburg Thalmann -- Analyst

Great. And then, given the success you've had with BELBUCA over the last year and especially last quarter, what are your thoughts now in terms of BUNAVAIL and the potential for that product, where you -- what you're thinking now?

Herm Cukier -- Chief Executive Officer

Hey, Matt. It's Herm, thanks so much for the questions and the accolades. Very proud of the work the team is doing. I think as we've been saying really since I joined the organization, our core strategic focus is capitalizing on the opportunity with BELBUCA. And I think again, we're off to a tremendous beginning of that process with significant ramp still to go and many more years to make these numbers happen. And that will remain and continue to be our core strategic focus. BUNAVAIL and the revenue that we received from the ex U.S. opportunities are complementary. We continue to manage them as such where it makes sense, we take advantage of that. But it's not an area that is a focus or attention. And as I've said all along, we will look for ways to continue to optimize the value proposition of all of our strategic assets, including BUNAVAIL. But for now, our focus remains and will remain to be the execution of BELBUCA.

Matt Kaplan -- Ladenburg Thalmann -- Analyst

Great. Great and then for Terry, I guess she mentioned in our prepared remarks, potential for increased operational efficiency. Looks like you've had some good results in terms of bringing down the cost of goods. Terry, could you give us some more color in terms of what you're thinking, what you're referring to in terms of operational efficiencies?

Terry Coelho -- Chief Financial Officer

Hi, Matt, it's nice to meet you. So, yes, I mean, look -- I think tomorrow marks two months that I'm with the Company and obviously they've been at a very busy time of the year and getting up to speed. And I'm looking across a number of areas, working with the rest of the leadership team to understand the properties and what the business is doing. Looking at everything from the operations through -- to working with sales and marketing and how we allocate our resources and prioritize as I mentioned earlier. So I'll share more in the future, I think, as we start to uncover that. But I think there are definitely opportunities.

Matt Kaplan -- Ladenburg Thalmann -- Analyst

And thanks for taking the question, guys. And..

Herm Cukier -- Chief Executive Officer

Thank very much, Matt. Really appreciate it.

Operator

Our next question comes from the line of Oren Livnat with HC Wainwright. Please proceed with your question.

Oren Livnat -- HC Wainwright -- Analyst

Hi. Thanks for taking the question. I was hoping to follow up on this head to head respiratory depression study. Firstly, could you just help us understand what really -- what the study is in terms of what are you comparing and what kind of patients or subjects and how? And I guess more importantly, do you think this is data that could actually make it into the label? And how long might that take if so? And would that give you a very important differentiator when you start going back to either guideline recommendations or managed care, where people are still having to step through CII opioids in some cases and maybe we get a big picture of change in the notion of even stepping through IR CII opioids before getting to your products?

Thomas B. Smith -- Chief Medical Officer

Hi, Oren. Thank you for the question, and as I mentioned, we're still kind of exploring what that study looks like right? So as I mentioned, we're considering the study design and the protocol itself. But the issue of respiratory depression, again, if you look among the adverse events of any of these agents is, respiratory depression. So, it's hard to say, is this the study that we've taken to the agency? No. But, it'll be interesting to see what the data shows us. And it will -- I think it will inform the appropriate parties as it comes out, right?

Oren Livnat -- HC Wainwright -- Analyst

Okay. Sound like it's a work in progress. Okay, that's it for me. Thanks.

Thomas B. Smith -- Chief Medical Officer

Okay, thanks, Oren.

Herm Cukier -- Chief Executive Officer

Thank you Oren.

Operator

Ladies and gentlemen, we have reached the end of the question-and-answer session, and I would like to turn the call back to Herm for closing remarks.

Herm Cukier -- Chief Executive Officer

Thank you very much, operator. Again, thank you very much for joining on our call today. We're extremely proud of the work that we've accomplished in the fourth quarter and full year 2018. We're pleased by the early momentum that we have in 2019 and we look forward to coming back in early May and sharing the results of the first quarter of operation of the Company. So, wishing everyone a wonderful rest of the afternoon and a great rest of the week. Thank you very much.

Operator

This concludes today's conference, you may disconnect your lines at this time. Thank you for your participation.

Duration: 47 minutes

Call participants:

Terry Coelho -- Chief Financial Officer

Herm Cukier -- Chief Executive Officer

Scott Plesha -- President and Chief Commercial Officer

Thomas B. Smith -- Chief Medical Officer

Brandon Folkes -- Cantor Fitzgerald -- Analyst

Esther Hong -- Janney -- Analyst

Tim Lugo -- Tim Lugo -- Analyst

Matt Kaplan -- Ladenburg Thalmann -- Analyst

Oren Livnat -- HC Wainwright -- Analyst

More BDSI analysis

Transcript powered by AlphaStreet

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

The Finland-based network equipment maker said on Friday that it was examining transactions at Alcatel-Lucent, a former rival it acquired back in 2016. The comments were made in relation to compliance issues at the unit to U.S. authorities.

The Finland-based network equipment maker said on Friday that it was examining transactions at Alcatel-Lucent, a former rival it acquired back in 2016. The comments were made in relation to compliance issues at the unit to U.S. authorities.

Lakeland Bancorp (NASDAQ:LBAI) was downgraded by investment analysts at BidaskClub from a “sell” rating to a “strong sell” rating in a research note issued to investors on Thursday.

Lakeland Bancorp (NASDAQ:LBAI) was downgraded by investment analysts at BidaskClub from a “sell” rating to a “strong sell” rating in a research note issued to investors on Thursday.

Source: Shutterstock

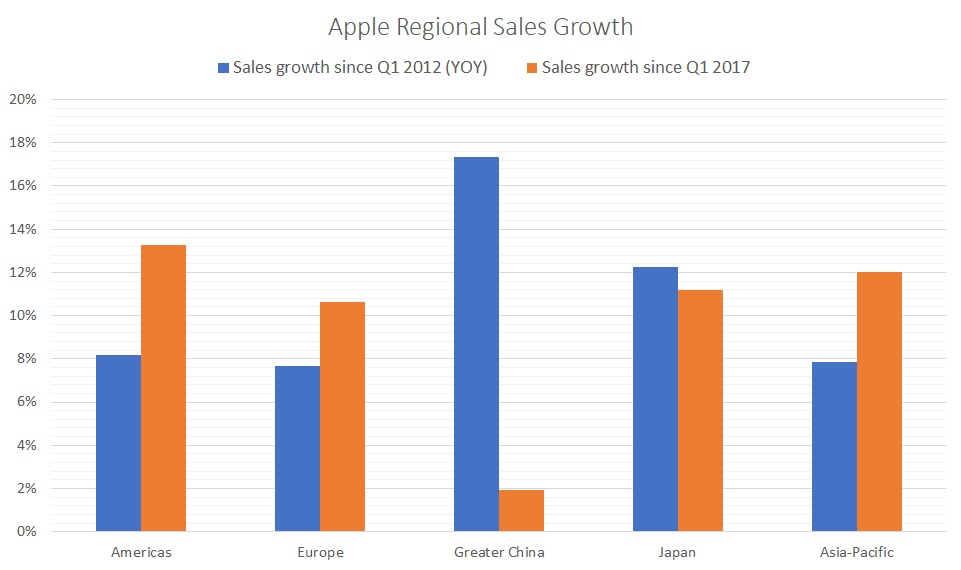

Source: Shutterstock  Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period.

Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period.