U.S. stock futures fell on Wednesday as geopolitical and trade concerns continued to nag at investors, taking the wind out of a rally seen at the start of the week.

Earnings from Target Corp. and then later the release of minutes from the latest Federal Open Market Committee meeting are among the highlights of the session ahead.

What are markets doing?

Dow Jones Industrial Average futures YMM8, -0.54% slipped 54 points, or 0.2%, to 24,792, while S&P 500 futures ESM8, -0.47% lost 5.6 points, or 0.2%, to 2,720.50. Nasdaq-100 futures NQM8, -0.74% fell 29.75 points, or 0.4%, to 6,879.75.

On Wednesday, the Dow Jones Industrial Average DJIA, -0.72% dropped 178.88 points, or 0.7%, to reach 24,834.41. The S&P 500 SPX, -0.31% lost 0.3% to end at 2,724.44, while the Nasdaq Composite Index COMP, -0.21% shed 15.58 points, or 0.2%, to close at 7,378.46.

Read: Why the end is coming soon for the biggest tech bubble we��ve ever seen

What��s driving the market?

Trade and geopolitical concerns continued to overshadow markets on Wednesday. President Donald Trump told reporters he wasn��t really happy with the progress of U.S.-China trade talks, and hinted that his summit with North Korean leader Kim Jong Un may not go ahead as planned.

Fiscal stimulus may swing back into focus after Trump said Tuesday evening that his administration will be ��submitting additional tax cuts sometime before November. It��s going to be something very special.��

What��s on the economic docket?

Markit��s May purchasing managers�� indexes for both manufacturing and services are scheduled for release at 9:45 a.m. Eastern Time. New-home sales for April are due at 10 a.m. Eastern.

At 2 p.m. Eastern, the minutes of the May meeting of Federal Reserve policy makers will be released.

Check out: Fed may float new ideas to market in the minutes

Which stocks are in focus?

Lowe��s Companies Inc. LOW, -1.88% �, Target Corp. TGT, -1.82% �, Tiffany & Co. TIF, -0.97% � and Ralph Lauren Corp. RL, -0.40% � are expected to report earnings ahead of the open, with the financial update from L. Brand Inc. LB, -0.18% �due after the close.

Read: Target earnings preview �� shoppers are showing up for the exclusive brands

Banks could be in focus after the House on Tuesday voted for a plan to roll back parts of the 2010 Dodd-Frank financial law. The move would ease rules placed on small and midsize banks during the financial crisis.

Wynn Resorts Ltd. WYNN, -0.15% �shares could be active after shareholders voted against the company��s executive compensation plan.

What did other markets do?

Asian markets had a rough session, with the Nikkei NIK, -1.18% �dropping more than 1% on yen strength. European stocks SXXP, -0.70% SXXP, -0.70% are set to open lower.

The ICE Dollar Index was steady, but the greenback is also lower against the pound GBPUSD, -0.4095% �. The 10-year U.S. Treasury note yield TMUBMUSD10Y, -1.38% �dipped to 3.05%.

A pullback for U.S. oil futures CLM8, -0.21% continued to pull lower. Gold futures GCM8, -0.02% were steady at $1,291.60 an ounce.

Read: Here��s what an ��oil shock�� would mean for the global economy

Economic preview: Rising rates, higher gas have failed to kill the economic expansion

Related Topics U.S. Stocks Markets NY Stock Exchange NASDAQ Quote References YMM8 -134.00 -0.54% ESM8 -12.75 -0.47% NQM8 -51.25 -0.74% DJIA -178.88 -0.72% SPX -8.57 -0.31% COMP -15.58 -0.21% LOW -1.64 -1.88% TGT -1.40 -1.82% TIF -1.00 -0.97% RL -0.47 -0.40% LB -0.06 -0.18% WYNN -0.30 -0.15% NIK -270.60 -1.18% SXXP -2.79 -0.70% GBPUSD -0.0055 -0.4095% TMUBMUSD10Y -0.04 -1.38% CLM8 -0.15 -0.21% GCM8 -0.30 -0.02% Show all references MarketWatch Partner Center Most Popular

Thinking of selling your home? Do it before 2020, economists say

Why the end is coming soon for the biggest tech bubble we��ve ever seen

Here��s what happens if the oil rally turns into an ��oil shock��

Trump hints at more tax cuts to be unveiled before November

Here's all you need to do in your 30s for a great financial future

Barbara Kollmeyer

Barbara Kollmeyer is an editor for MarketWatch in Madrid. Follow her on Twitter @bkollmeyer.

Barbara Kollmeyer

Barbara Kollmeyer is an editor for MarketWatch in Madrid. Follow her on Twitter @bkollmeyer.

We Want to Hear from You

Join the conversation

Comment Community Guidelines �� FAQs BACK TO TOP MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile Company Company Info Code of Conduct Corrections Advertising Media Kit Advertise Locally Reprints & Licensing Your Ad Choices Dow Jones Network WSJ.com Barron's Online BigCharts Virtual Stock Exchange Financial News London WSJ.com Small Business realtor.com Mansion Global

Copyright © 2018 MarketWatch, Inc. All rights reserved.

By using this site you agree to the Terms of Service, Privacy Policy, and Cookie Policy.

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Advanced Search Stocks Columns Authors Topics No results found E-Mini Dow Jun 2018 U.S.: CBOT: YMM8 $24,711.00 -134.00 (-0.54%)

| Volume | 24556 |

| Open | $24,836 |

| High | $24,845 |

| Low | $24,686 |

| P/E Ratio | 0 |

| Div Yield | 0 |

| Market Cap | N/A |

E-Mini S&P 500 Future Jun 2018 U.S.: CME: ESM8 2,713.25 -12.75 (-0.47%)

| Volume | 78181 |

| Open | 2,725 |

| High | 2,726 |

| Low | 2,711 |

| P/E Ratio | 0 |

| Div Yield | 0 |

| Market Cap | N/A |

E-Mini Nasdaq 100 Index Jun 2018 U.S.: CME: NQM8 6,858.00 -51.25 (-0.74%)

| Volume | 33557 |

| Open | 6,906 |

| High | 6,908 |

| Low | 6,846 |

| P/E Ratio | 0 |

| Div Yield | 0 |

| Market Cap | N/A |

Dow Jones Industrial Average DJ-Index: DJIA 24,834.41 -178.88 (-0.72%)

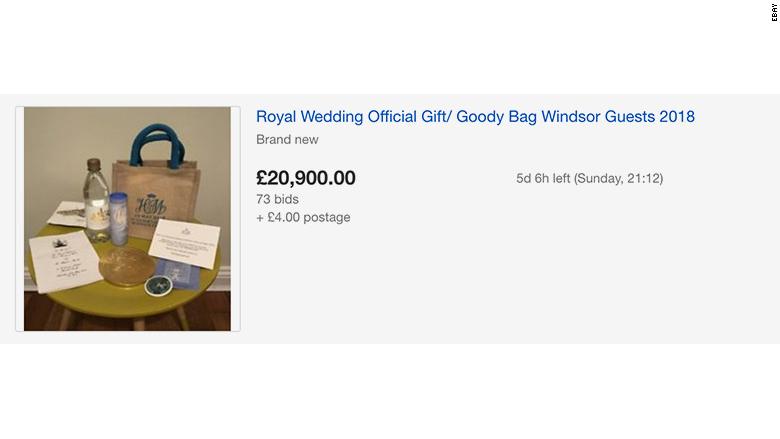

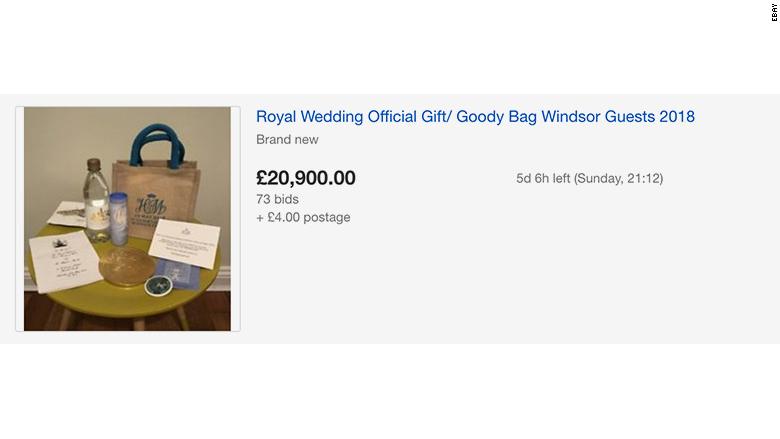

The guests at Saturday's wedding of Prince Harry and Meghan Markle got to witness royal history in the making -- and now they can make some cash from it too.

Dozens of official goody bags from the wedding have been popping up on eBay since Saturday. By Tuesday, several of the bags had sold, fetching up to 拢7,900 ($10,600), Bidding on others was still active, with the top bid surpassing 拢27,000 ($36,260).

The simple canvas tote bags were given to the carefully selected group of members of public who were invited to the grounds of Windsor Castle on Saturday to see the wedding up close.

The brown and blue bags contained the wedding program, a box of shortbread cookies, a large chocolate coin, a fridge magnet, a bottle of water and a 20% discount voucher for the Windsor Castle gift shop.

Kensington Palace declined to comment for this story.

More than 2,600 members of the public were invited into the grounds of the castle on the wedding day.

Kensington Palace said the guests were a mixture of people representing charities the royal couple supports, pupils from local schools, Windsor community members, the royal household staff, as well as members of public who have shown strong leadership and have served their communities.

They were invited to stand outside St. George's Chapel during the ceremony, witnessing the arrivals of the couple and their guests, as well as the first kiss of the newly wedded Duke and Duchess of Sussex.

HC Wainwright set a $10.00 target price on Magic Software Enterprises (NASDAQ:MGIC) in a research note released on Thursday morning. The firm currently has a buy rating on the software maker’s stock.

HC Wainwright set a $10.00 target price on Magic Software Enterprises (NASDAQ:MGIC) in a research note released on Thursday morning. The firm currently has a buy rating on the software maker’s stock.

Other equities analysts have also recently issued reports about the company. BidaskClub cut Magic Software Enterprises from a hold rating to a sell rating in a report on Tuesday, May 8th. Zacks Investment Research cut Magic Software Enterprises from a hold rating to a sell rating in a report on Saturday, February 10th. Finally, ValuEngine cut Magic Software Enterprises from a buy rating to a hold rating in a report on Monday, May 7th. One analyst has rated the stock with a sell rating, two have given a hold rating and two have issued a buy rating to the stock. The company has an average rating of Hold and an average price target of $9.75.

Get Magic Software Enterprises alerts:

Shares of Magic Software Enterprises opened at $8.50 on Thursday, according to MarketBeat. Magic Software Enterprises has a 12-month low of $7.60 and a 12-month high of $9.50. The company has a current ratio of 3.04, a quick ratio of 3.07 and a debt-to-equity ratio of 0.13. The firm has a market capitalization of $378.16 million, a P/E ratio of 18.48 and a beta of 0.75.

Magic Software Enterprises (NASDAQ:MGIC) last issued its earnings results on Wednesday, May 16th. The software maker reported $0.14 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $0.13 by $0.01. Magic Software Enterprises had a return on equity of 10.41% and a net margin of 5.90%. The company had revenue of $69.73 million for the quarter, compared to analysts’ expectations of $66.55 million. sell-side analysts forecast that Magic Software Enterprises will post 0.57 earnings per share for the current fiscal year.

Several institutional investors and hedge funds have recently modified their holdings of the stock. Clal Insurance Enterprises Holdings Ltd lifted its holdings in shares of Magic Software Enterprises by 9.9% in the 4th quarter. Clal Insurance Enterprises Holdings Ltd now owns 1,315,872 shares of the software maker’s stock worth $11,024,000 after purchasing an additional 118,890 shares in the last quarter. Delek Group Ltd. purchased a new stake in Magic Software Enterprises in the 4th quarter valued at $6,150,000. Meitav Dash Investments Ltd. purchased a new stake in Magic Software Enterprises in the 4th quarter valued at $5,201,000. Renaissance Technologies LLC raised its position in Magic Software Enterprises by 9.3% in the 4th quarter. Renaissance Technologies LLC now owns 428,651 shares of the software maker’s stock valued at $3,591,000 after buying an additional 36,599 shares during the last quarter. Finally, Unterberg Capital LLC raised its position in Magic Software Enterprises by 354.5% in the 1st quarter. Unterberg Capital LLC now owns 170,876 shares of the software maker’s stock valued at $1,452,000 after buying an additional 133,276 shares during the last quarter. Institutional investors own 12.82% of the company’s stock.

About Magic Software Enterprises

Magic Software Enterprises Ltd. provides proprietary application development, business process integration, and vertical software solutions and related professional services in Israel and internationally. The company's Software Solutions segment develops, markets, sells, and supports a proprietary and none proprietary application platform, software applications, and business and process integration solutions and related services.

Mackay Shields LLC bought a new position in shares of K12 (NYSE:LRN) during the first quarter, HoldingsChannel reports. The fund bought 134,753 shares of the company’s stock, valued at approximately $1,911,000.

Mackay Shields LLC bought a new position in shares of K12 (NYSE:LRN) during the first quarter, HoldingsChannel reports. The fund bought 134,753 shares of the company’s stock, valued at approximately $1,911,000.

Several other large investors have also recently modified their holdings of LRN. BlackRock Inc. raised its position in shares of K12 by 6.3% during the fourth quarter. BlackRock Inc. now owns 2,573,649 shares of the company’s stock worth $40,921,000 after purchasing an additional 152,056 shares during the period. Renaissance Technologies LLC grew its holdings in K12 by 13.8% during the fourth quarter. Renaissance Technologies LLC now owns 1,020,700 shares of the company’s stock worth $16,229,000 after buying an additional 123,600 shares in the last quarter. Thrivent Financial For Lutherans bought a new stake in K12 during the fourth quarter worth $1,817,000. Arrowstreet Capital Limited Partnership grew its holdings in K12 by 112.9% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 215,313 shares of the company’s stock worth $3,423,000 after buying an additional 114,193 shares in the last quarter. Finally, Royce & Associates LP grew its holdings in K12 by 26.0% during the fourth quarter. Royce & Associates LP now owns 550,728 shares of the company’s stock worth $8,757,000 after buying an additional 113,617 shares in the last quarter. 82.28% of the stock is currently owned by institutional investors.

Get K12 alerts:

Several equities research analysts recently issued reports on the company. Zacks Investment Research upgraded K12 from a “hold” rating to a “buy” rating and set a $17.00 price target for the company in a report on Friday, April 27th. BMO Capital Markets decreased their price target on K12 from $20.00 to $19.00 and set an “outperform” rating for the company in a report on Wednesday, April 25th. Barrington Research reiterated a “buy” rating and set a $22.00 price target on shares of K12 in a report on Thursday, April 12th. Finally, ValuEngine downgraded K12 from a “sell” rating to a “strong sell” rating in a report on Wednesday, May 2nd. Two analysts have rated the stock with a sell rating, one has issued a hold rating and two have issued a buy rating to the company. K12 presently has an average rating of “Hold” and a consensus price target of $19.33.

Shares of K12 opened at $15.99 on Friday, Marketbeat Ratings reports. K12 has a 12-month low of $12.72 and a 12-month high of $19.92. The firm has a market cap of $659.99 million, a P/E ratio of 35.53, a P/E/G ratio of 1.78 and a beta of 0.01. The company has a quick ratio of 3.77, a current ratio of 3.92 and a debt-to-equity ratio of 0.02.

K12 (NYSE:LRN) last announced its quarterly earnings results on Tuesday, April 24th. The company reported $0.32 earnings per share (EPS) for the quarter, missing the Thomson Reuters’ consensus estimate of $0.34 by ($0.02). K12 had a return on equity of 3.75% and a net margin of 1.32%. The company had revenue of $232.90 million for the quarter, compared to the consensus estimate of $227.30 million. During the same quarter last year, the company posted $0.42 EPS. The company’s quarterly revenue was up 4.7% compared to the same quarter last year. equities analysts anticipate that K12 will post 0.6 EPS for the current year.

In other K12 news, insider Kevin Chavous sold 3,491 shares of the company’s stock in a transaction on Monday, May 7th. The stock was sold at an average price of $15.20, for a total value of $53,063.20. Following the completion of the transaction, the insider now owns 60,424 shares in the company, valued at approximately $918,444.80. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 18.34% of the stock is owned by corporate insiders.

K12 Profile

K12 Inc, a technology-based education company, together with its subsidiaries, provides online curriculum, software systems, and educational services to facilitate individualized learning for students primarily in kindergarten through 12th grade in the United States and internationally. It manages virtual and blended public schools.

Want to see what other hedge funds are holding LRN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for K12 (NYSE:LRN).

Clayton, Missouri-based FutureFuel Corporation (FF), through its subsidiaries, manufactures and sells various chemical products, bio-based products (including bio-based specialty chemical products) in the United States. The business operates in two segments: Chemicals and Biofuels. The chemicals segment includes custom chemicals, agro chemicals, additives for detergents, biocides agents, specialist polymers, dyes, stabilizers, and chemicals agents (which are the chemicals used in cosmetics and personal care products), and specialist products used in the fuels industry.

What initially caught my attention on this particular stock is the way in which it has performed over the past couple of days, with significant price spikes backed by strong volume. What is more intriguing is the fact that this recent movement has come after the Q1 earnings announcement last Thursday, when the stock actually moved down on selling the news (May 10th):

May 09th: Closed at $11.82 on volume of 38.5k

May 10th: Closed at $11.48 on volume of 84.5k

May 11th: Closed at $11.55 on volume of 42.2k

May 14th: Closed at $11.90 on volume of 144.9k

May 15th: Closed at $12.70 on volume of 140.0k

(Source: FinViz)

(Source: FinViz)

Post earnings last Thursday, the stock dropped down to around $11.44 with a small spike in volume. At the time, in my view (although impossible to confirm), this was most likely down to large hands buying up shares from the post-earnings sellers expecting further dips.

It is the following 2-3 days of price and volume activity in this stock, which provides the strongest evidence that large hands have been actively moving into this stock. The average volume in this stock over the past 90 days sits at around 65k/day. The last two days have seen relative volume multiples hit 2.15 times and 2.22 times the average. This is strong accumulation, which is always an initial prompt for me to at least look into this company.

At the current price, the stock still has plenty of room to grow, and I am expecting this one to at least hit the first strong resistance at 13.50, purely ion a technical basis (backed by recent strong volume accumulation) before consolidating and moving higher. The chart above also shows what is potentially a bottom, with multiple supports at around 11.50 since April.

From last Thursday's Q1 report, revenues were $55.7 million, up 3.0% from $54.1 million; excluding the impact of the blenders�� tax credit (��BTC��), revenues were $69.3 million, up 28.1%. Adjusted EBITDA was $37.6 million, up from $5.6 million; excluding the benefit of the BTC, adjusted EBITDA was $8.7 million, up 55.4%. Bottom line, the net income increased to $40.4 million, or $0.92 per diluted share, from $3.4 million, or $0.08 per diluted share, significantly benefited by the BTC.

The BTC, or Blenders Tax Credit, is a biodiesel blender that is registered with the IRS, eligible for a tax incentive of $1/gallon of pure biodiesel, agri-biodiesel, or renewable diesel blended with petroleum diesel to produce a mixture containing at least 0.1% diesel fuel. FutureFuel qualifies for this, and it adds a sustainable $1 per gallon tax credit to the bottom line. This is likely to continue for the foreseeable future. If established (as it is likely to do so) over a longer term, the company valuation remains presently discounted.

However, what matters beyond the transient politics of the BTC are the increased production and sales volumes within both the chemical and biofuel segments, reflected in top line revenues and gross profit growth.

Beyond the mainstream numbers, the company has the following key metrics in its favor:

Cash and Equivalents of $232.57m represent a large proportion (42%) of market cap ($555.52m). Cash and Equivalents of $232.57m represent a large proportion (42%) of enterprise value ($322.95m). The company has zero debt on its balance sheet (Total Debt reported last quarter). All other credentials pass within our screener, notably: Operating Income to Enterprise Value is 12.69% (meets minimum 4%) Free Cash Flow to Enterprise Value is 6.59% (meets minimum 4%) Debt to Equity is Zero (meets maximum 50%) Debt to Capital is Zero (meets maximum 50%)

(Source: S&P/CapitalIQ)

With fundamentals intact there is not a lot of negative counterbalance to report on FF at present - suffice it to say, price and volume activity from the recent bottom of around $11.50 seem to be pointing to strong accumulation, backed by both price and strong multiple relative-volume activity.

My thesis is largely based on strong accumulation which is continuing this week. The volumes traded in the stock are above average. FF stock was purchased by a variety of institutional investors in the last quarter, including Dimensional Fund Advisors LP, Millennium Management LLC, Matarin Capital Management LLC, BlackRock Inc., GSA Capital Partners LLP, Personal Resources Investment & Strategic Management Inc., Element Capital Management LLC and Citadel Advisors LLC. Company insiders that have bought FutureFuel stock in the last two years include Donald C Bedell, Keith Neumeyer and Samir Devendra Patel. (Source: MarketBeat).

FutureFuel is a diversified company with many sub-divisions servicing distinct markets under the one umbrella of chemicals and biofuels. It is still small (and nimble), in a potential growth sector through more diversification, especially within the chemicals segment, for which FF enjoys more established markets. The company has had a turnaround in demonstrating one of the strongest FCF/EV yields I have seen in some time. This is in my opinion, a significantly undervalued, speculative (higher-risk-capital) bet.

Disclosure: I am/we are long FF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

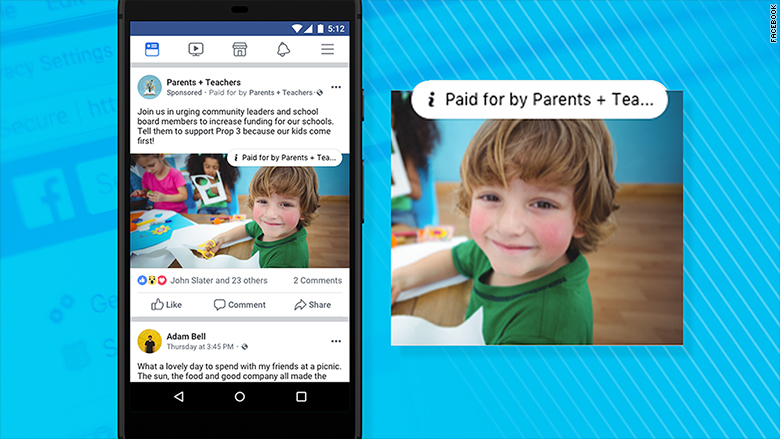

Facebook released an example of what the ad labels will look like on Thursday

Facebook released an example of what the ad labels will look like on Thursday  Shares of Amgen (NASDAQ:AMGN) have earned an average recommendation of “Hold” from the twenty-seven research firms that are presently covering the company, Marketbeat reports. Two investment analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and ten have given a buy rating to the company. The average 1 year target price among brokers that have issued a report on the stock in the last year is $193.19.

Shares of Amgen (NASDAQ:AMGN) have earned an average recommendation of “Hold” from the twenty-seven research firms that are presently covering the company, Marketbeat reports. Two investment analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and ten have given a buy rating to the company. The average 1 year target price among brokers that have issued a report on the stock in the last year is $193.19.  Thinking of selling your home? Do it before 2020, economists say

Thinking of selling your home? Do it before 2020, economists say  Why the end is coming soon for the biggest tech bubble we��ve ever seen

Why the end is coming soon for the biggest tech bubble we��ve ever seen  Here��s what happens if the oil rally turns into an ��oil shock��

Here��s what happens if the oil rally turns into an ��oil shock��  Trump hints at more tax cuts to be unveiled before November

Trump hints at more tax cuts to be unveiled before November  Here's all you need to do in your 30s for a great financial future

Here's all you need to do in your 30s for a great financial future  Barbara Kollmeyer

Barbara Kollmeyer

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Advanced Search Stocks Columns Authors Topics No results found E-Mini Dow Jun 2018 U.S.: CBOT: YMM8 $24,711.00 -134.00 (-0.54%)

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Advanced Search Stocks Columns Authors Topics No results found E-Mini Dow Jun 2018 U.S.: CBOT: YMM8 $24,711.00 -134.00 (-0.54%)

HC Wainwright set a $10.00 target price on Magic Software Enterprises (NASDAQ:MGIC) in a research note released on Thursday morning. The firm currently has a buy rating on the software maker’s stock.

HC Wainwright set a $10.00 target price on Magic Software Enterprises (NASDAQ:MGIC) in a research note released on Thursday morning. The firm currently has a buy rating on the software maker’s stock. Mackay Shields LLC bought a new position in shares of K12 (NYSE:LRN) during the first quarter, HoldingsChannel reports. The fund bought 134,753 shares of the company’s stock, valued at approximately $1,911,000.

Mackay Shields LLC bought a new position in shares of K12 (NYSE:LRN) during the first quarter, HoldingsChannel reports. The fund bought 134,753 shares of the company’s stock, valued at approximately $1,911,000.  (Source: FinViz)

(Source: FinViz)