Here is the transcript of the exclusive interview on CNBC-TV18. Also watch the accompanying video.

Q: What exactly does one mean when one talks about instruments of fund raising?

Nayar: I think as a company looks at its growth plans and capital expenditure requirements, they obviously take care of it through internal resources first. Over and above that they have options of raising either debt or equity. Within equity also there can be pure equity or convertibles, which are equity like instruments which get converted to equity or can stay as debt.

Q: Is this always done in order to do capital raising or sometimes it is also done in order to get in a strategic investor etc. In that, are there different layers to why a company chooses to do fund raising or is it just as simple as the capex issue?

Chatterjee: From a pure corporate finance point of view, there would be several angles to look at it. If one looks at fund raising for capex, which is the most obvious, whether it is in capex or growth, one first one needs to ensure that the company's long-term strategy is aligned to growth. And, within growth then to use fund raising as the enabler to make it happen.

Sometimes one looks at the capital structure and the need to balance capital structure either ways, whether it is towards debt or equity, it depends on where that structure is, if it is over capitalized in terms of equity and you are paying too much taxes, you would certainly want to get some tax shield to ensure that there is a rebalancing and it can be vice-versa.

The third thing is the instrument selection or the financing strategy. One looks at what instruments work for that particular company, given its track record of cash flows and earnings.

And, finally one looks at the market and sees what is the right time to access the market and in which form.

Did you read: Tata Power ends $300M PE fund-raising with Olympus Cap

Q: From a minority shareholders point of view, how should one read these fund raising exercises by a company? Do they have an impact on the company's core business or performance as a stock as well?

Sharma: Yes, certainly. Depending on what kind of fund raising it is, whether it is equity or debt and also from perspective of which investor base it is raising. The existing minority shareholders if they do not participate in that equity offering will get diluted. So to that extent they will be impacted. As long as it is debt, they also need to look at how it impacts the capital structure and the future growth of the company.

Q: On the equity side, one can raise money via an initial public offering (IPO) which is step one, but how beneficial is it going down the equity route whether it is an IPO or a preferential share issue from a company's point of view?

Chatterjee: Equity is obviously a form of capital raising where one has to be very careful in the context of two to three things. One is in the earnings per share (EPS) implications of raising equity. Whether one goes through an IPO or a private placement or bring in strategic investors, is functional of again where the capital structure wants to be. And, if one wants to have an equity-biased capital structure we need to look at raising equity.

A listed company would perhaps go in for a follow-on public offer (FPO) or a private placement or induction of a strategic partner or even a preferential allotment to the existing shareholders.

For an unlisted company, it could be in the form of an IPO or simple private placement by a financial or strategic partner. So, the key consideration is whether that equity which is effectively costlier than debt can be serviced and can be value accretive going forward for the shareholders.

Q: What exactly should a retail investor or any shareholder actually look at when a company announces equity offering because there is a) potential dilution that will happen b) potential dilution on the earnings itself. I guess if it's preferential you will have to wonder about which kind of parties are coming into the company.

Sharma: I think from the perspective of any investors, categorized into two'one who is an existing shareholder and two is somebody who is coming in new. What they need to look at is going top down in terms of what the industry dynamics are. How the company is doing in that industry and finally what the backing of the promoters or other strategic investors is. Also they need to look at what is the planned fund raising going to be used for. That is also important consideration because it would have an impact on future growth of the company.

Q: You have participated and run many follow-on offers for companies, how does one marry this mismatch that starts happening between the listed price and the way it starts reacting to news of a follow-on because immediately for many stocks especially from the public sector there is a deceleration in the price performance expecting the FPO to be at a much lower price point?

Nayar: Usually follow-on have little more flexibility on pricing. Also, since it's a more intensive an effort in terms of distribution and there is whole host of cost that go along with it, the feeling is that one will try and price it in such a way that the follow-on goes through and doesn't lead to an overhang.

Any retail investor would not like to pay a premium because they can buy that stock in the market at market related prices. So, most follow-ons always happen at a discount of about 5%. So usually in that sense investors start expecting 3-5% discount and start playing on that arbitrage.

Q: How elegant an option is it when you look at equity fund raising instruments because you have to consider the retail minority shareholder, you have to consider some kind of discount and you also have to take into account the kind of pressure your stock may face because of that impending follow-on offer?

Chatterjee: In India the route to access the capital markets especially in the secondary side, for a listed company, depends on how the stock performs post the announcement. The period to close fund raising is very critical to ensure that there is a balance between what the company wants and what the investor wants. I still believe that rights and FPO should be done in a shorter period of time and that would be a great benefit both to the issuer as well as the investor.

1 2

.gD_15nRedN{font:15px/20px Arial;color:#FF0000 !important;text-decoration:none;font-weight:normal;}

Related News

India relaxes steel import standards Adanis close to acquiring Dhamra Port

.gD_15nRed{font:15px/20px Arial;color:#FF0000 !important;text-decoration:none;font-weight:bold;}

.GoogleNewsTitle{font:14px/16px Trebuchet MS,Arial,Helvetica,sans-serif;color:#005066;text-decoration:none;} .GoogleNewsTitle:hover{text-decoration:underline} .GoogleNewsURL{font:12px Trebuchet MS,Arial,Helvetica,sans-serif;color:#000;text-decoration:none;} .GoogleNewsURL:hover{text-decoration:underline} .GoogleNewsTitleLine{font:20px/22px Trebuchet MS,Arial,Helvetica,sans-serif;color:#F01414;text-decoration:none} .GoogleNewsTitleLine:hover{text-decoration:underline} .GoogleNewsLineURL{font:12px family:Trebuchet MS,Arial,Helvetica,sans-serif;color:#000;text-decoration:none} .GoogleNewsLineURL:hover{text-decoration:underline}

Set email alert for

Tata Steel

Tags: fund raising, Informed Investor, Mitali Mukherjee, Koushik Chatterjee, Tata Steel, Falguni Nayar, Kotak, Sanjay Sharma, Deutsche Equities

Know the finer points in clubbing income with spouse

Hilton Worldwide launches new global careers website

.scroll_hv .panel{width:250px !important; padding:10px 10px 25px !important} #scroll13{width:540px;} .hv_bx{margin-left:-10px;} .tab_data1{padding:0px;}

Get Quote Stock Chart Future Price Option Price NAVs News Business Earnings Management Interviews Announcements Stock Views Brokerage Reports Announcements Board Meetings AGM/EGM Bonus Rights Splits Dividends Information Company History Background Board of Directors Capital Structure Listing Info Locations Block Deals Financials Balance Sheet Profit & Loss Quarterly Results Half Yearly Results Nine Monthly Results Yearly Results Cash Flow Ratios Annual Report Directors Report Chairman's Speech Auditors Report Notes to Accounts Finished Goods Raw Materials Peer Comparison Price Price Performance Market Cap Net Sales Net Profit Total Assets | | Most Popular Top News Experts laud Cipla Q1 results; doubt Sun Pharma guidance Reliance, IOC, ONGC bid for Guj terminal stake Continue buying pharma; bullish on HCL Tech: Sanju Verma Here's what to expect from SBI Q1 earnings Sun Pharma posts Rs 1276 cr loss in Q1 on Pfizer settlement Govt approves setting up of 12 mega food parks RBI's tightening measures can pull GDP to sub 5%: Experts Micromax co-founder 'steps down from his duties' RBI takes further step to stem rupee's slide against USD Here's what to expect from SBI Q1 earnings Analysts worry GDP downgrade as bankers remain upbeat Eicher aims to be global mid sized motorcycle provider Robert Vadra falsified documents for Gurgaon land: Khemka Further rupee steps expected in Indian debt/FX RBI's tightening measures can pull GDP to sub 5%: Experts Jeff Bezos pretty close to be next Steve Jobs: John Sculley Companies Bill: Here are the pleasure and pain points Pak violates ceasefire again, fires 7k round of ammunition Here's what to expect from SBI Q1 earnings Analysts worry GDP downgrade as banker

When market volatility spikes or stalls, newspapers, websites, bloggers and television commentators all refer to the VIX®.Formally known as the CBOE Volatility Index, the VIX is a benchmark index designed specifically to track S&P 500 volatility. Most investors familiar with the VIX commonly refer to it as the "fear gauge", because it has become a proxy for market volatility.

The VIX was created by the Chicago Board Options Exchange (CBOE), which bills itself as "the largest U.S. options exchange and creator of listed options". The CBOE runs a for-profit business selling (among other things) investments to sophisticated investors. These include hedge funds, professional money managers and individuals that make investments seeking to profit from market volatility. To facilitate and encourage these investments, the CBOE developed the VIX, which tracks market volatility on a real-time basis.

While the math behind the calculation and the accompanying explanation takes up most of a 15-page white paper published by the CBOE, we'll provide the highlights in a lite overview. As my statistics professor once said, "It's not so important that you are able to complete the calculation. Rather, I want you to be familiar with the concept." Keeping in mind that he was teaching statistics to a room full of people who were not math majors, let's take a layman's look at the calculations behind the VIX, courtesy of examples and information provided by the CBOE. A Lite Look for the Mildly Curious

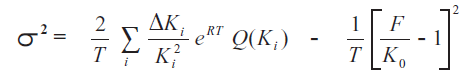

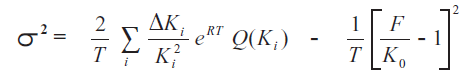

The CBOE provides the following formula as a general example of how the VIX is calculated:

The calculations behind each part of the equation are rather complex for most people who don't do math for a living. They are also far too complex to fully explain in a short article, so let's put some numbers into the formula to make the math easier to follow:

Delving into the Details

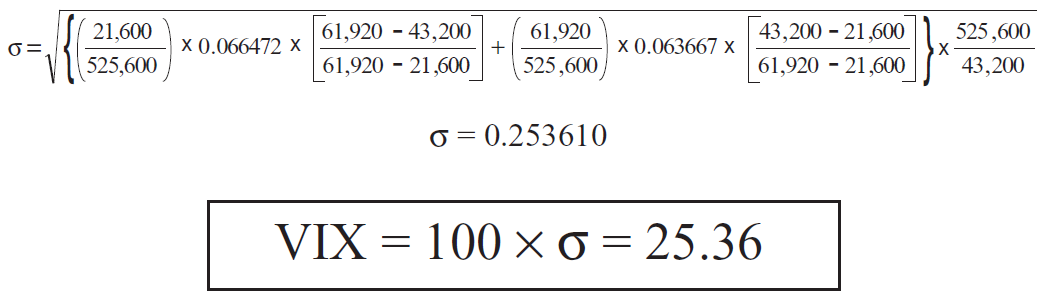

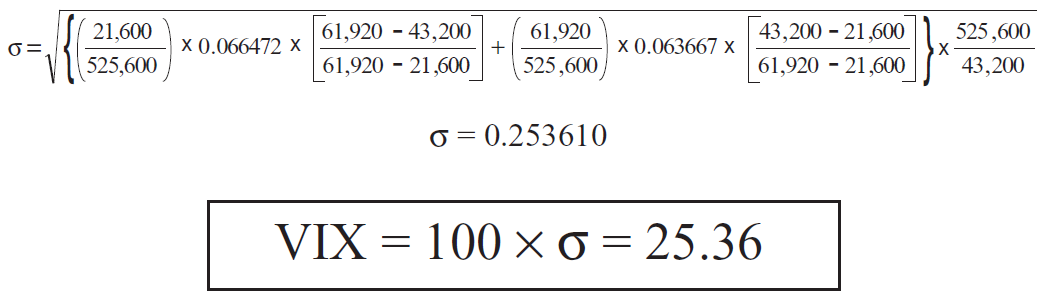

The VIX is calculated using a "formula to derive expected volatility by averaging the weighted prices of out-of-the-money puts and calls". Using options that expire in 16 and 44 days, respectively, in the example below, and starting on the far left of the formula, the symbol on the left of "=" represents the number that results from the calculation of the square root of the sum of all the numbers that sit to the right multiplied by 100. To get to that number:

The first set of numbers to the right of "=" represents time. This figure is determined by using the time to expiration in minutes of the nearest term option divided by 525,600, which represents the number of minutes in a 365-day year. Assuming the VIX calculation time is 8:30am, the time to expiration in minutes for the 16-day option will be the number of minutes within 8:30am today and 8:30am on the settlement day. In other words, the time to expiration excludes midnight to 8:30am today and excludes 8:30 am to midnight on the settlement day (full 24 hours excluded). The number of days we'll be working with will technically be 15 (16 days minus 24 hours), so it's 15 days x 24 hours x 60 minutes = 21,600. Use the same method to get the time to expiration in minutes for the 44-day option to get 43 days x 24 hours x 60 minutes = 61,920 (Step 4).

The result is multiplied by the volatility of the option, represented in the example by 0.066472.

The result is then multiplied by the result of the difference between the number of minutes to expiration of the next term option (61,920) minus the number of minutes in 30 days (43,200). This result is divided by the difference of the number of minutes to expiration of the next term option (61,920) minus the number of minutes to expiration of the near term option (21,600). Just in case you're wondering where 30 days came from, the VIX uses a weighted average of options with a constant maturity of 30 days to expiration.

The result is added to the sum of the time calculation for the second option, which is 61,920 divided by the number of minutes in a 365-day year (526,600). Just as in the first calculation, the result is multiplied by the volatility of the option, represented in the example by 0.063667.

Next we repeat the process covered in step 3, multiplying the result of step 4 by the difference of the number of minutes in 30 days (43,200), minus the number of minutes to expiration of the near-term options (21,600). We divide this result by the difference of the number of minutes to expiration of the next-term option (61,920) minus the number of minutes to expiration of the near-term options (21,600).

The sum of all previous calculations is then multiplied by the result of the number of minutes in a 365-day year (526,600) divided by the number of minutes in 30 days (43,200).

The square root of that number multiplied by 100 equals the VIX.

Heavy on the Math

Clearly, order of operations is critical in the calculation and, for most of us, calculating the VIX isn't the way we would choose to spend a Saturday afternoon. And if we did, the exercise would certainly take up most of the day. Fortunately, you will never have to calculate the VIX because the CBOE does it for you. Thanks to the magic of computers, you can go online, type in the ticker VIX and get the number delivered to your screen in an instant. Investing in Volatility

Volatility is useful to investors, as it gives them a way to gauge the market environment. It also provides investment opportunities. Since volatility is often associated with negative stock market performance, volatility investments can be used to hedge risk. Of course, volatility can also mark rapidly rising markets. Whether the direction is up or down, volatility investments can also be used to speculate.

As one might expect, investment vehicles used for this purpose can be rather complex. VIX options and futures provide popular vehicles through which sophisticated traders can place their hedges or implement their hunches. Professional investors use these on a routine basis.

Exchange-traded notes - a type of unsecured, unsubordinated debt security - can also be used. ETNs that track volatility include the iPath S&P 500 VIX Short-Term Futures (NYSE:VXX) and the Velocityshares Daily Inverse VIX Short-Term (NYSE:XIV). Exchange-traded funds offer a somewhat more familiar vehicle for many investors. Volatility ETF options include the ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) and ProShares VIX Mid-Term Futures (NYSE:VIXM).

There are pros and cons to each of these investment vehicles that should be thoroughly evaluated before making investment decisions. The Bottom Line

Regardless of purpose (hedging or speculation) or the specific investment vehicles chosen, investing in volatility is not something to jump into without taking some time to understand the market, the investment vehicles and the range of possible outcomes. Failing to do the proper preparation and take a prudent approach to investing can have a more detrimental result to your personal bottom line than making a mathematical error in your VIX calculation.

They're some of the most overlooked income investments. I'm willing to bet that nine out of 10 investors don't even consider them when they're buying an income stock... That's a shame because if you know what to look for, these securities can be some of the most powerful portfolio builders around. I'm talking about investing in stocks with low dividend yields. I know, it might seem counterintuitive, but sometimes lower-yielding stocks can be better than their high-yield counterparts. Don't believe me? Consider two stocks, one that pays 5% and another that yields 3%. It seems like a no-brainer to go with the stock that is yielding 5%. However, if that low-yield stock can appreciate just 3% a year -- while maintaining its 3% yield -- it can outperform a static 5% yielding stock in just three year's time. In ten years, you can double your money with the low-yielding -- but growing -- security.

And if you can find a security with a little higher yield or a slightly higher growth rate, it gets even better. Of course, in order to achieve results like these, you need to find stocks that have the ability to consistently grow year in and year out... and at the same time keep up with their dividend payments. Finding those stocks is easier said than done. However, if you look for these four things, then you could substantially increase your chances of finding the market's best low-yielders. These traits only take about two minutes to look for, but they could lead you to one of the best income investments you've ever made... 1. A Dividend Track Record

The best indication a stock can maintain its dividend is if it has a history of raising it. When a company steadily increases its dividend for years, then chances are it has a commitment to its dividend policy and a willingness to share its growing income with shareholders. In other words, if a company is raising its dividend now, it is unlikely to be stingy in the near future. 2. A Low Payout Ratio

When looking for the market's best dividend payers, it's imperative to look at a company's payout ratio. The payout ratio measures the percentage of a company's earnings it pays out in dividends. For instance, if a company earns $.75 per share in a quarter and pays a $0.25 per share dividend, its payout ratio is 33% ($0.25/$0.75). While there is no exact rule of thumb, a lower payout ratio indicates that a company has more income that it could dedicate to dividends. A high payout ratio indicates that the company may already be paying out all that it can afford. 3. Revenue Growth

This one is pretty much self-explanatory. In order for a company to continue to grow and maintain its dividend, then it needs to continue to increase its top line. Show me a company that is selling more goods and services and I'll show you a stock that has the potential to appreciate. 4. A Compelling Story for Future Growth

The past and present are good guideposts for selecting a low-yielding stock with appreciation potential. But the day you buy a stock, the future is what's key. In order to really be a successful dividend stock, the company has to have a convincing growth story. Does it have a new compelling product or technology? Is it capitalizing on a new consumer trend? Is it expanding its business into new, fast-growing, geographic regions? The simpler the story, the more comfortable I am. If it involves too many chapters -- or if the planets have to align -- then it may not be the story worth an investment. Action to Take --> Of course, just because a stock has these four traits it doesn't necessarily mean it will be a stock worth buying. But the more of these qualities a company has, the more likely it is to steadily grow your portfolio for years to come. P.S. -- If you haven't done so, you can learn more about the strategies I use in my income investing advisory, The Daily Paycheck, here. In the past year, I've collected more than $15,570 in dividends. Learn more about how you can do the same thing by visiting this link.

On this day in economic and business history... World War I began and ended on June 28. It was on June 28, 1914 that the Archduke Franz Ferdinand fell to an assassin's bullet. Exactly five years later, on June 28, 1919, the Treaty of Versailles recorded Germany's final and humiliating capitulation, setting in motion the events that would shape the remainder of the 20th century. Between these two bookends of history, nearly 10 million men died in Europe's trenches, six million civilians lost their lives, and the world woke up to the realities of brutal machine-driven warfare. It would be a month before World War I officially began following Ferdinand's assassination. During this time, the Austro-Hungarian Empire, Ferdinand's birthright, pressured Serbia to the point of oppression over the role of its nationalists in Ferdinand's death. A web of complex alliances quickly formed around old imperialist interests during this month, which led to a cascading chain of war declarations once Serbia refused to give in to Austria-Hungary's unreasonable demands. Two days after Austria-Hungary declared war on Serbia, Germany mobilized for an assault on France, and American stock markets were shut down by government order. The four-month closure -- during which time the belligerent Europeans realized that new battlefield technologies (barbed wire, poison gas, and machine guns among them) made large-scale infantry charges little more than failed bloodbaths -- also marks the "modernization" of the Dow Jones Industrial Average (DJINDICES: ^DJI ) . The index now retroactively updates its values based on component changes only as far back as the market's reopening at the end of 1914. During this four-month shutdown, many leading American industrial enterprises became "war brides" married to European armed forces and, as a result ,the Dow doubled in the two years following the resumption of trading. Thousands of miles of trenches were dug into the bloody Western Front across Belgium and France, where millions would die on the war's major theater. However, it was indeed a "world" war -- fighting raged across much of Europe, but also extended into Africa, Asia, and the oceans, where Germany deployed submarines in battle for the first time. Germany's aggressive use of submarines, or U-boats, forced the United States into the war in 1917. American troops did not contribute greatly to the end of the war, but did participate in some key battles that led to Germany's capitulation on "the eleventh hour of the eleventh day of the eleventh month" -- 11 in the morning on November 11, 1918. The Treaty of Versailles, signed exactly five years after World War I was set in motion, was the result of six months of contentious negotiation. It was denounced by famed economist John Maynard Keynes as a crushing "Carthaginian peace" that would devastate Germany's economy and create widespread unrest in the defeated nation. Its steep requirements -- which forced Germany to cede territory, accept military occupation, nearly demilitarize, and pay billions of dollars in reparations (initially set at a level equivalent to $440 billion in modern terms) -- did indeed stir up widespread anger in Germany, which would nurse a grudge against its conquerors for years. However, historical views of the treaty have softened considerably in recent years as the totality of its consequences became apparent. Germany's restricted army saved it a tremendous amount of money before Hitler's rearmament in the '30s, and the shakeup of European powers -- Austria-Hungary was ruined, and Russia sank into revolution -- left Germany with no significant challengers to the east or south when it sought to reassert its continental hegemony two decades later. It might even be argued that the treaty was not harsh enough -- rather than crippling Germany and ending its threat, it only made the country's extreme nationalists more determined to rise again. Billiton's beginnings

Tin was first discovered on the Sumatran island of Billiton (Belitung ) on June 28, 1851. Nine years later, a company of the same name was formed in the Netherlands to exploit the resource-rich island. For over a century, Billiton dominated the mining industry of the Indonesian archipelago, and eventually would expand its reach and business range throughout the world. Billiton merged with Australian metals leader BHP (Broken Hill Proprietary) in 2001 to form BHP Billiton (NYSE: BHP ) (NYSE: BBL ) , which is now the largest mining company in the world. Won't you buy me a Mercedes-Benz?

One of the world's most iconic luxury vehicle nameplates was formed on June 28, 1926, when Benz & Cie and Daimler Motoren Gesellschaft finally merged after a two-year corporate partnership to create Daimler-Benz AG (NASDAQOTH: DDAIF ) . The Benz name, despite a stronger automotive pedigree (Karl Benz did invent the modern automobile, after all), wound up secondary to Daimler's Mercedes brand. Daimler's three-pointed star logo also wound up on the new company's cars, further cementing its primacy in the ostensible merger of equals. Daimler, despite its luxury appeal, has since become a widely diversified automaker, with a product lineup ranging from tiny Smart compact cars to lumbering Freightliner 18-wheelers. This diversity has helped the company become the world's third-largest automaker, with over $150 billion in annual sales. With the American markets reaching new highs, investors and pundits alike are skeptical about future growth. They shouldn't be. Many global regions are still stuck in neutral, and their resurgence could result in windfall profits for select companies. A recent Motley Fool report, "3 Strong Buys for a Global Economic Recovery," outlines three companies that could take off when the global economy gains steam. Click here to read the full report!

|