Polaris Industries (PII), which designs, engineers, manufactures, and markets off-road vehicles, snowmobiles, motorcycles, and small vehicles in the United States, Canada, and Western Europe is a strong buy even at current levels. This article discusses the positives related to the company making it a good stock to own for long-term.

Polaris Industries has surged by 9.8% in the last two trading sessions. The reason for the strong upside is the company's stellar results for the second quarter of 2014 and with higher guidance for 2014; the upside in the stock is likely to continue.

Polaris has been a consistent performer and the second quarter of 2014 is the 19th consecutive quarter of record performance by the company. The company sales increased by 20% to $1 billion, net income increased by 21% to $80 million and the EPS increased by 26% to $.142 as compared to 2Q13. Therefore, the overall results were robust and it contributed to the surge in the stock.

Polaris Industries has been on a sustained growth path through the launch of new products and through innovation and the past record is indicative of a good management and company strategy. The company has recorded 5-year sales CAGR of 14%, net income growth of 27% and EPS growth of 25%. The company's ROA has also increased from 13% in 2009 to 24% in 2013 and the company's ROIC has increased from 26% to 43% during the same period. All these factors combine to make Polaris an excellent fundamental driven stock to invest.

In the near-term, the positive factor will be the company's full year results and the revised guidance. This will keep the stock momentum going. For 2014, Polaris expects the EPS to be in the range of $6.48 to $6.58. Polaris Industries is therefore trading at a forward PE of 22 considering the current price of $146.2 and the higher end of the guidance of $6.58.

I believe that valuations are not expensive with mean analyst estimates suggesting that the company is likely to have an EPS of $7.83 for 2015. This would imply another 19% growth as compared to the likely EPS for 2014. Polaris Industries will therefore continue to grow at a robust pace and a PE of 22 looks fair in this scenario.

Looking at the future growth drivers, I believe that Polaris Industries is doing well in making inroads into international markets and emerging markets can significant contribute to the company's growth in the future. International sales increased by 29% to $592 million in 2013 as compared to $461 million in 2012. Even for 2014, the company expects double digits growth in international sales. Of the company's international sales, the exposure to Asia Pacific is only 14% and the exposure to Latin America is also low at 7%. I believe these will be the key focus markets for Polaris Industries to boost growth.

As a part of their long-term strategy, Polaris Industries has already planned revenue growth in excess of $2 billion through acquisitions and exposure to high growth markets. With a sales target of $8 billion by 2020, focus on high growth markets is certainly critical.

Another interesting point to note is the company's growth in the motorcycle segment. Revenue surged by 107% to $103 million in 2Q14 as compared to $49.9 million in 2Q13. The company's retail sales and dealer expansion contributed to the growth in the segment. This segment of the company competes directly with Harley Davidson (HOG).

I am bullish on Harley Davidson as well for the future, but in the near-term, Polaris Industries has been a clear winner. Harley Davidson has reduced its annual growth guidance at a time when the motorcycle segment is growing at a scorching pace for Polaris Industries. Both these companies however offer a good dividend yield of 1.5% at current market price.

In conclusion, Polaris Industry is in the midst of strong growth and the stock looks attractive for the medium to long-term. Further, the company's growth guidance for 2014 is strong and analyst estimates for 2015 is also robust.

This implies that the company will continue to have strong quarters and investors can consider the stock even at these levels. I do believe that broad market valuations are bit stretched and investors need to buy the stock in a staggered manner to average out on any decline.

About the author:Faisal HumayunSenior Research Analyst with experience in the field of equity research, credit research, financial modelling and economic research

| Currently 3.00/512345 Rating: 3.0/5 (1 vote) | Voters: |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

PII STOCK PRICE CHART

149.29 (1y: +36%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PII',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1374728400000,109.6],[1374814800000,108.86],[1375074000000,108.89],[1375160400000,110.09],[1375246800000,112.14],[1375333200000,115.12],[1375419600000,115.07],[1375678800000,115.14],[1375765200000,115.21],[1375851600000,112.67],[1375938000000,113.49],[1376024400000,113.41],[1376283600000,113.12],[1376370000000,116.39],[1376456400000,115.97],[1376542800000,113.17],[1376629200000,113.61],[1376888400000,112.9],[1376974800000,114.02],[1377061200000,113.4],[1377147600000,112.98],[1377234000000,114.02],[1377493200000,113.54],[1377579600000,109.89],[1377666000000,110.79],[1377752400000,111.1],[1377838800000,109.21],[1378184400000,109.86],[1378270800000,111.12],[1378357200000,112.24],[1378443600000,111.57],[1378702800000,114.73],[1378789200000,121.1],[1378875600000,121.02],[1378962000000,120.6],[1379048400000,121.99],[1379307600000,123.89],[1379394000000,125.68],[1379480400000,126.38],[1379566800000,126.6],[1379653200000,124.77],[1379912400000,125.17],[1379998800000,125.54],[1380085200000,126.11],[1380171600000,128.33],[1380258000000,128.2],[1380517200000,129.18],[1380603600000,130.66],[1380690000000,128.5],[1380776400000,129.73],[1380862800000,134.33],[1381122000000,129.95],[1381208400000,125.98],[1381294800000,124.7],[1381381200000,129.08],[1381467600000,130.37],[1381726800000,131.27],[1381813200000,130.1],[1381899600000,132.47],[1381986000000,132.92],[1382072400000,134.74],[1382331600000,136.03],[1382418000000,130.69],[1382504400000,132.83],[1382590800000,133.07],[1382677200000,133.01],[1382936400000,131.3],[1383022800000,131.88],[1383109200000,130.53],[1383195600000,130.95],[1383282000000,131.09],[1383544800000,133.18],[1383631200000,132.15],[1383717600000,130.27],[1383804000000,126.24],[1383890400000,127.13],[1384149600000,130.24],[1384236000000,130.11],[1384322400000,136.21],[1384408800000,134.03],[1384495200000,134.8],[1384754400000,131.83],[1384840800000,130.53],[138492720000! 0,130.73],[1385013600000,134.46],[1385100000000,133.74],[1385359200000,134.35],[1385445600000,134.12],[1385532000000,133.98],[1385704800000,133.47],[1385964000000,132.99],[1386050400000,133.26],[1386136800000,133.88],[1386223200000,135.13],[1386309600000,135.98],[1386568800000,138.8],[1386655200000,138.76],[1386741600000,134.88],[1386828000000,134.42],[1386914400000,133.83],[1387173600000,135.54],[1387260000000,135.9],[1387346400000,139.91],[1387432800000,139.59],[1387519200000,141.57],[1387778400000,143.21],[1387864800000,142.96],[1388037600000,144.23],[1388124000000,143.33],[1388383200000,145.78],[1388469600000,145.64],[1388642400000,145],[1388728800000,144.62],[1388988000000,143.64],[1389074400000,144.78],[1389160800000,145.5],[1389247200000,144.97],[1389333600000,143.66],[1389592800000,138.97],[1389679200000,140.17],[1389765600000,139.63],[1389852000000,138.11],[1389938400000,136.89],[1390284000000,135.92],[1390370400000,141.36],[1390456800000,137.45],[1390543200000,133],[1390802400000,132.1],[1390888800000,128.12],

NEW YORK (CNNMoney) Ben Bernanke, the former head of the Federal Reserve, said the 2008 financial crisis was the worst in global history, surpassing even the Great Depression.

NEW YORK (CNNMoney) Ben Bernanke, the former head of the Federal Reserve, said the 2008 financial crisis was the worst in global history, surpassing even the Great Depression.

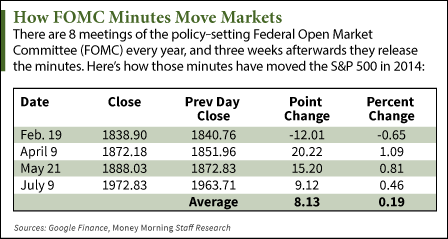

Fedspeak, no matter how dry and technical, has the ability to move markets because it gives hints as to what the country's long-term monetary outlook will be.

Fedspeak, no matter how dry and technical, has the ability to move markets because it gives hints as to what the country's long-term monetary outlook will be.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  149.29 (1y: +36%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PII',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1374728400000,109.6],[1374814800000,108.86],[1375074000000,108.89],[1375160400000,110.09],[1375246800000,112.14],[1375333200000,115.12],[1375419600000,115.07],[1375678800000,115.14],[1375765200000,115.21],[1375851600000,112.67],[1375938000000,113.49],[1376024400000,113.41],[1376283600000,113.12],[1376370000000,116.39],[1376456400000,115.97],[1376542800000,113.17],[1376629200000,113.61],[1376888400000,112.9],[1376974800000,114.02],[1377061200000,113.4],[1377147600000,112.98],[1377234000000,114.02],[1377493200000,113.54],[1377579600000,109.89],[1377666000000,110.79],[1377752400000,111.1],[1377838800000,109.21],[1378184400000,109.86],[1378270800000,111.12],[1378357200000,112.24],[1378443600000,111.57],[1378702800000,114.73],[1378789200000,121.1],[1378875600000,121.02],[1378962000000,120.6],[1379048400000,121.99],[1379307600000,123.89],[1379394000000,125.68],[1379480400000,126.38],[1379566800000,126.6],[1379653200000,124.77],[1379912400000,125.17],[1379998800000,125.54],[1380085200000,126.11],[1380171600000,128.33],[1380258000000,128.2],[1380517200000,129.18],[1380603600000,130.66],[1380690000000,128.5],[1380776400000,129.73],[1380862800000,134.33],[1381122000000,129.95],[1381208400000,125.98],[1381294800000,124.7],[1381381200000,129.08],[1381467600000,130.37],[1381726800000,131.27],[1381813200000,130.1],[1381899600000,132.47],[1381986000000,132.92],[1382072400000,134.74],[1382331600000,136.03],[1382418000000,130.69],[1382504400000,132.83],[1382590800000,133.07],[1382677200000,133.01],[1382936400000,131.3],[1383022800000,131.88],[1383109200000,130.53],[1383195600000,130.95],[1383282000000,131.09],[1383544800000,133.18],[1383631200000,132.15],[1383717600000,130.27],[1383804000000,126.24],[1383890400000,127.13],[1384149600000,130.24],[1384236000000,130.11],[1384322400000,136.21],[1384408800000,134.03],[1384495200000,134.8],[1384754400000,131.83],[1384840800000,130.53],[138492720000! 0,130.73],[1385013600000,134.46],[1385100000000,133.74],[1385359200000,134.35],[1385445600000,134.12],[1385532000000,133.98],[1385704800000,133.47],[1385964000000,132.99],[1386050400000,133.26],[1386136800000,133.88],[1386223200000,135.13],[1386309600000,135.98],[1386568800000,138.8],[1386655200000,138.76],[1386741600000,134.88],[1386828000000,134.42],[1386914400000,133.83],[1387173600000,135.54],[1387260000000,135.9],[1387346400000,139.91],[1387432800000,139.59],[1387519200000,141.57],[1387778400000,143.21],[1387864800000,142.96],[1388037600000,144.23],[1388124000000,143.33],[1388383200000,145.78],[1388469600000,145.64],[1388642400000,145],[1388728800000,144.62],[1388988000000,143.64],[1389074400000,144.78],[1389160800000,145.5],[1389247200000,144.97],[1389333600000,143.66],[1389592800000,138.97],[1389679200000,140.17],[1389765600000,139.63],[1389852000000,138.11],[1389938400000,136.89],[1390284000000,135.92],[1390370400000,141.36],[1390456800000,137.45],[1390543200000,133],[1390802400000,132.1],[1390888800000,128.12],

149.29 (1y: +36%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PII',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1374728400000,109.6],[1374814800000,108.86],[1375074000000,108.89],[1375160400000,110.09],[1375246800000,112.14],[1375333200000,115.12],[1375419600000,115.07],[1375678800000,115.14],[1375765200000,115.21],[1375851600000,112.67],[1375938000000,113.49],[1376024400000,113.41],[1376283600000,113.12],[1376370000000,116.39],[1376456400000,115.97],[1376542800000,113.17],[1376629200000,113.61],[1376888400000,112.9],[1376974800000,114.02],[1377061200000,113.4],[1377147600000,112.98],[1377234000000,114.02],[1377493200000,113.54],[1377579600000,109.89],[1377666000000,110.79],[1377752400000,111.1],[1377838800000,109.21],[1378184400000,109.86],[1378270800000,111.12],[1378357200000,112.24],[1378443600000,111.57],[1378702800000,114.73],[1378789200000,121.1],[1378875600000,121.02],[1378962000000,120.6],[1379048400000,121.99],[1379307600000,123.89],[1379394000000,125.68],[1379480400000,126.38],[1379566800000,126.6],[1379653200000,124.77],[1379912400000,125.17],[1379998800000,125.54],[1380085200000,126.11],[1380171600000,128.33],[1380258000000,128.2],[1380517200000,129.18],[1380603600000,130.66],[1380690000000,128.5],[1380776400000,129.73],[1380862800000,134.33],[1381122000000,129.95],[1381208400000,125.98],[1381294800000,124.7],[1381381200000,129.08],[1381467600000,130.37],[1381726800000,131.27],[1381813200000,130.1],[1381899600000,132.47],[1381986000000,132.92],[1382072400000,134.74],[1382331600000,136.03],[1382418000000,130.69],[1382504400000,132.83],[1382590800000,133.07],[1382677200000,133.01],[1382936400000,131.3],[1383022800000,131.88],[1383109200000,130.53],[1383195600000,130.95],[1383282000000,131.09],[1383544800000,133.18],[1383631200000,132.15],[1383717600000,130.27],[1383804000000,126.24],[1383890400000,127.13],[1384149600000,130.24],[1384236000000,130.11],[1384322400000,136.21],[1384408800000,134.03],[1384495200000,134.8],[1384754400000,131.83],[1384840800000,130.53],[138492720000! 0,130.73],[1385013600000,134.46],[1385100000000,133.74],[1385359200000,134.35],[1385445600000,134.12],[1385532000000,133.98],[1385704800000,133.47],[1385964000000,132.99],[1386050400000,133.26],[1386136800000,133.88],[1386223200000,135.13],[1386309600000,135.98],[1386568800000,138.8],[1386655200000,138.76],[1386741600000,134.88],[1386828000000,134.42],[1386914400000,133.83],[1387173600000,135.54],[1387260000000,135.9],[1387346400000,139.91],[1387432800000,139.59],[1387519200000,141.57],[1387778400000,143.21],[1387864800000,142.96],[1388037600000,144.23],[1388124000000,143.33],[1388383200000,145.78],[1388469600000,145.64],[1388642400000,145],[1388728800000,144.62],[1388988000000,143.64],[1389074400000,144.78],[1389160800000,145.5],[1389247200000,144.97],[1389333600000,143.66],[1389592800000,138.97],[1389679200000,140.17],[1389765600000,139.63],[1389852000000,138.11],[1389938400000,136.89],[1390284000000,135.92],[1390370400000,141.36],[1390456800000,137.45],[1390543200000,133],[1390802400000,132.1],[1390888800000,128.12],

Steve Remich

Steve Remich  Patrick Strattner/fStop Images We always seem to be looking for ways to make extra money. All the better if we can earn it in ways that fit our schedule and keep us out of another office. One appealing way is mystery shopping -- going to a store or restaurant, oftentimes getting wined and dined for free, and then filling out a survey rating your experience. Seems easy, right? There's more than meets the eye to this covert work. We know because we tried it out for a couple of months when we were living in New York City. Here are some considerations when it comes to deciding if mystery shopping is for you.

Patrick Strattner/fStop Images We always seem to be looking for ways to make extra money. All the better if we can earn it in ways that fit our schedule and keep us out of another office. One appealing way is mystery shopping -- going to a store or restaurant, oftentimes getting wined and dined for free, and then filling out a survey rating your experience. Seems easy, right? There's more than meets the eye to this covert work. We know because we tried it out for a couple of months when we were living in New York City. Here are some considerations when it comes to deciding if mystery shopping is for you.

Popular Posts: 22 New Stocks to Watch – Mobileye, Synchrony Financial & MoreSpaceX IPO Rumors – Real Stock Launch or Science Fiction?How Venture Capital Revolutionized U.S. Businesses Recent Posts: Time Warner Shareholders Get Outfoxed Sirius XM – Investors Should Start to Tune Into SIRI Stock TripAdvisor Investors Get Queasy (TRIP) View All Posts Time Warner Shareholders Get Outfoxed

Popular Posts: 22 New Stocks to Watch – Mobileye, Synchrony Financial & MoreSpaceX IPO Rumors – Real Stock Launch or Science Fiction?How Venture Capital Revolutionized U.S. Businesses Recent Posts: Time Warner Shareholders Get Outfoxed Sirius XM – Investors Should Start to Tune Into SIRI Stock TripAdvisor Investors Get Queasy (TRIP) View All Posts Time Warner Shareholders Get Outfoxed  Yet even with all the drama, there may still be a good opportunity with TWX stock.

Yet even with all the drama, there may still be a good opportunity with TWX stock.